MBA Chart of the Week: Benefits of a Digital Mortgage

Source: MBA Digital Mortgage Technology Profile.

In January, MBA Research released the results of its Digital Mortgage Technology Profile Survey, the third in a series of semi-annual technology profile surveys conducted since 2016. The Digital Mortgage Technology Profile Survey was completed by Chief Information Officers from 20 mortgage companies who are also participants in MBA’s Lender CIO Forum.

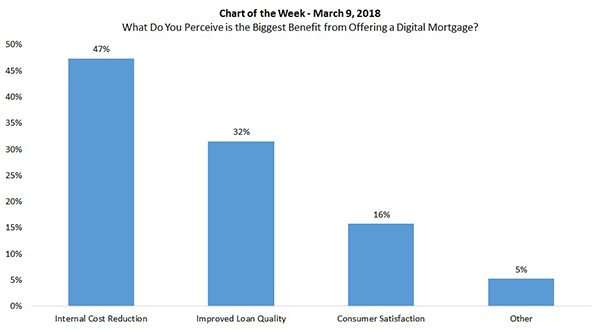

Today’s Chart of the Week features results on what lender CIOs perceive as the biggest benefit of offering a digital mortgage–defined as a loan where all documents, including the note, are electronic and all or most of the loan processing and consumer interaction occurs online.

Nearly half (47 percent) of respondents cited “internal cost reduction” as the top reason for offering a digital mortgage, likely in response to the ramp up in loan production costs, as seen in MBA’s Quarterly Performance Report, where the average cost to originate a loan rose to $8,060 among independent mortgage bankers in 3rd quarter 2017, compared to a $6,090 per loan average for all quarters from 3Q08 -3Q17. Other benefits of a digital mortgage cited by CIOs include improved loan quality (32 percent) and consumer satisfaction in the originations process (16 percent). Responses captured under “Other” were improved efficiencies and “all of the above” (5 percent).

A 20-page summary PowerPoint, a helpful tool for anyone who is exploring digitizing any part of their loan production process is available for purchase by clicking https://www.mba.org/store/products/market-and-research-data/mba-digital-mortgage-technology-profile.

If you are the lead technology officer in a lending and/or servicing organization and would like to participate in the Lender CIO Forum, please contact Rick Hill at rhill@mba.org.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Rick Hill is vice president of industry technology with MBA; he can be reached at rhill@mba.org. Jenny Masoud is research analyst with MBA; she can be reached at jmasoud@mba.org.)