MBA Chart of the Week: IMB Loan Amounts for Retail/Consumer Direct Production Channels

Source: MBA Quarterly Mortgage Bankers Performance Report; www.mba.org/performancereport.

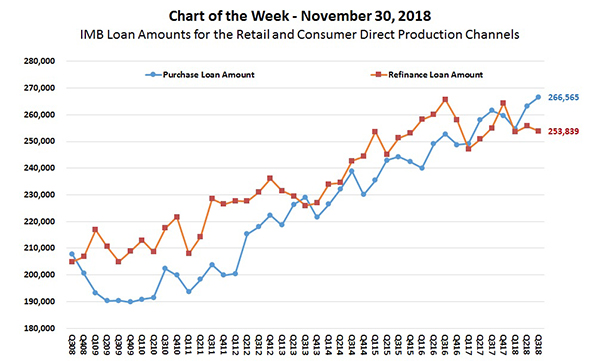

Today’s Chart of the Week compares the average purchase loan amount to the average refinance loan amount for those independent mortgage bankers who originate loans through the retail and/or consumer direct production channels exclusively, with no third-party originations volume.

Data are derived from the MBA Quarterly Mortgage Bankers Performance Report for independent mortgage bankers, with the most current 2018 data for the third quarter released Nov. 29.

Last quarter, the average purchase loan amount for the sample of 215 companies from the QPR reached $266,565–the highest for this cohort since the inception of the study in third quarter 2008. Since first quarter 2017, the average purchase loan amounts have exceeded the average refinance loan amounts in every quarter except for fourth quarter 2017 as home prices have escalated. This marks a change from pre-Q1 2017, in which the average refinance loan amounts were higher than the average purchase loan amounts in all but two quarters, likely driven by higher-balance borrowers choosing to refinance.

The purchase share for this cohort averaged 84 percent in the third quarter, which was also the highest percentage since inception of the study. For the mortgage industry as a whole, MBA estimates purchase share at 76 percent.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is associate director of analytics with MBA; she can be reached at jmasoud@mba.org.)