MBA Chart of the Week: Veterans Administration Purchase Mortgage Originations

Source: Mortgage Bankers Association Analysis of Home Mortgage Disclosure Act Data.

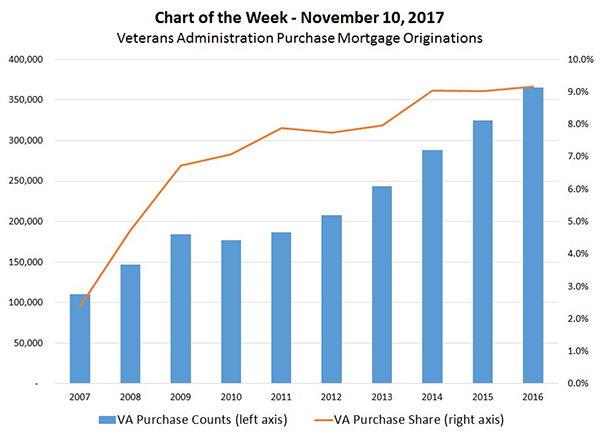

In observance of Veterans Day, we look at how the market for Veterans Administration guaranteed purchase mortgages has grown dramatically over the past 10 years using data from the Home Mortgage Disclosure Act.

There were nearly 365,000 VA loans for home purchase recorded by HMDA-reporting institutions in 2016, up from 325,000 loans in 2015 and 110,000 loans in 2007. As a share of all purchase loans reported in HMDA, VA home purchase lending grew to 9.2 percent in 2016 from just 2.4 percent in 2007.

Our HMDA data tracking goes back to 1999; the 2016 home purchase counts are the highest counts observed over this history for VA loans. Over the same period, the share of all VA lending that is for home purchase has varied widely between 31 and 96 percent and sat at 46 percent in 2016. The average VA home purchase loan size has grown steadily over time, standing at just over $256,000 in 2016.

The above analysis includes retail/broker first lien-only originations for home purchase of 1-4 unit homes, including manufactured homes.

Additional HMDA analysis MBA conducts can be found at https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/mba-residential-origination-databook-and-reports.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan is associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org).