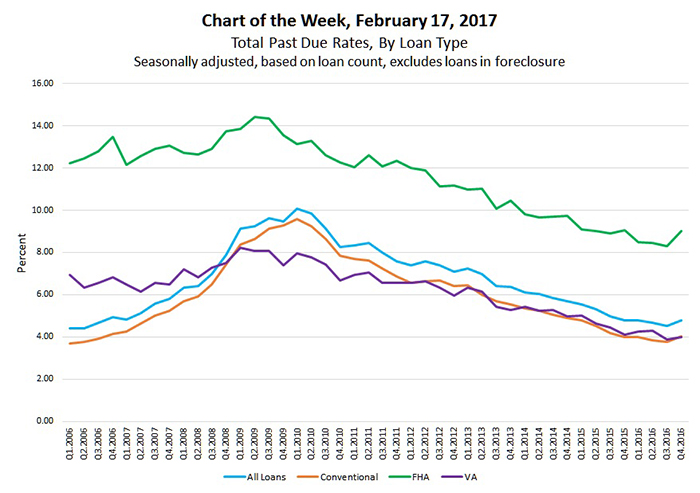

MBA Chart of the Week: Total Past Due Rates, By Loan Type

Source: MBA National Delinquency Survey

According the most recent MBA National Delinquency Survey (https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/national-delinquency-survey), the overall delinquency rate in the fourth quarter increased across all loan types–FHA, VA and conventional–compared to the third quarter.

These increases came after last quarter’s overall delinquency rate fell to its lowest level since 2006. Therefore it is not unexpected that delinquencies could eventually increase off such a low base. We continue to see strong fundamentals in the overall economy, such as rising home values and increased employment, which bodes well for the future performance of FHA, VA and conventional loans.

While the delinquency rate increased for all groups, FHA saw the greatest increase to 9.02 percent in the fourth quarter from 8.30 percent in the third quarter (its lowest level since 1997). This quarter’s increase was driven primarily by the FHA 30-day delinquency category. The increase in early stage FHA delinquencies was led by loans originated in 2014, 2015 and 2016. However, on a year-over-year basis, there was no increase in the overall FHA delinquency rate.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org. Brennan Zubrick is senior financial reporting and data management analyst with MBA; he can be reached at bzubrick@mba.org.)