MBA Chart of the Week: U.S. 10-Year Treasury Yields/Dow Jones Industrials

Source: Federal Reserve; Dow Jones

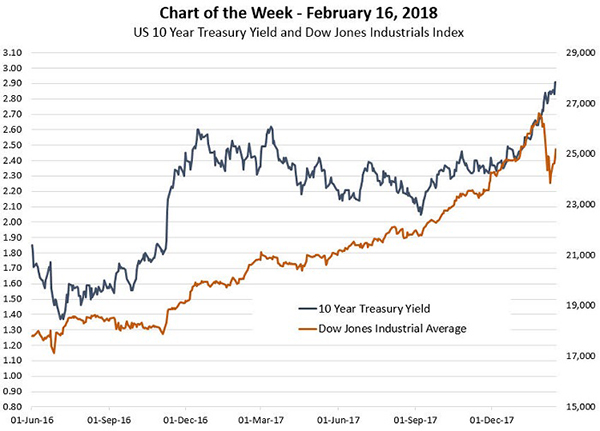

Over the past few weeks, markets reassessed prospects for inflation following a Bureau of Labor Statistics report that wages increased 2.9 percent in January on a year over year basis after a stagnant year of growth in the 2.5-2.6 percent range.

To the extent that firms can raise prices to support the pressure they are feeling to increase wages, wage growth will contribute to inflation. Wage growth could reach 3.5-4 percent by the end of this year. Additional inflationary pressure may come from the recent Tax Cut and Jobs Act, the budget deal which raised budget caps as well as from improved prospects for global growth.

What worries investors is that if inflation increases faster than expected, the Fed may be obliged to “slam on the brakes” to keep the economy from overheating by raising interest rates faster than expected.

BLS reported a large monthly increase in the January consumer price index, which further spurred 10-year rates upwards with yields breaching 2.9 percent on Wednesday. Our assessment is that, perhaps like last year, this very quick run-up in rates has absorbed a good bit of our forecasted increase in rates for the full year.

We continue to predict four short-term rate increases by the Fed this year and greater volatility in longer term interest rates. We also continue to expect that the 10-year yield will end up around 3.0 percent and the 30-year fixed rate will average about 4.8 percent in the fourth quarter.

(Michael Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan is associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org.)