MBA Chart of the Week: Year-Over-Year Contributions to Commercial Property Price Changes

Source: MBA, National Council of Real Estate Investment Ficuciaries.

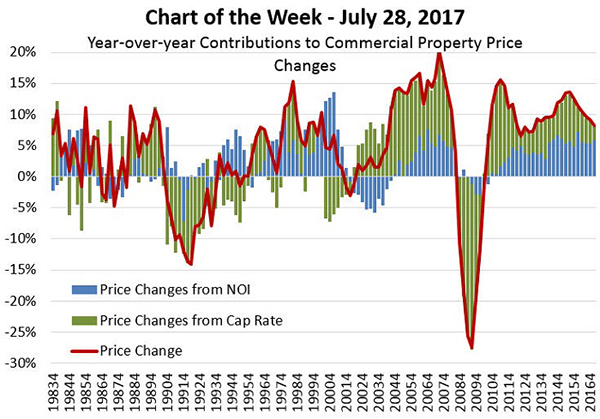

Commercial property prices are a function of the net income generated by the property and the capitalization (cap) rate.

Cap rates are essentially the yield investors require to invest in the property. A rise in net operating income will boost property values, as will a drop in the cap rate.

According to data from the National Council of Real Estate Investment Fiduciaries, in 42 of the past 50 quarters, NOIs and cap rates have both contributed to pushing property values higher.

Since the end of 2004–even including the impact of the Great Recession–property NOIs have increased by 52 percent (an average of 3.4 percent per year) and cap rates have fallen by 33 percent (an average of 3.2 percent per year). In combination, they have led to a 128 percent increase in property values, an average of 6.8 percent per year.

Property price growth has slowed of late, falling from 12.6 percent in 2015 to “just” 9.1 percent in 2016, with most of the fall-off coming from a slowdown in cap rate decline. Given expectations that interest rates and cap rates may have little room to move even further downward, and the maturing of the real estate cycle, property price growth is unlikely to maintain its recent supercharged pace.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)