MBA Chart of the Week: Commercial/Multifamily Mortgage Banker Originations, By Property Type

Source: MBA CREF Database.

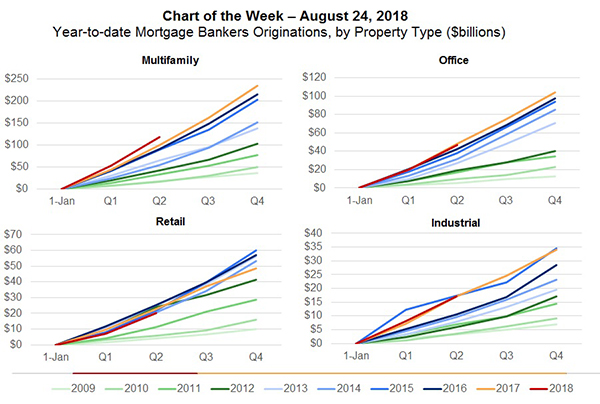

Commercial and multifamily mortgage borrowing and lending have started 2018 at the second fastest pace on record, with first-half 2018 originations lower only than those of the first half of 2007. This week’s chart shows origination growth for the four main categories of loans from 2009 to 2018 (year to date).

Activity continues to be driven by multifamily borrowing, which is running at a record pace. First-half multifamily originations in 2018 were 17 percent higher than in 2017 and 110 percent higher than in 2007. Originations of mortgages for industrial properties are also at a record level–matching 2017’s first-half dollar volume and 60 percent higher than 2007’s first-half. New loans on office and retail properties are both being made below last year’s pace, and are 60 and 70 percent, respectively, lower than 2007.

The first half of 2018 marked the fastest start to a year for lending by the government sponsored enterprises (Fannie Mae and Freddie Mac) and by life insurance companies, as new loan demand continues to be supported by still-low long-term interest rates, growing property incomes and rising values.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)