From Senators, Pessimism on Housing Reform

WASHINGTON–Senators from both sides of the aisle, appearing here at the Mortgage Bankers Association’s National Advocacy Conference, expressed skepticism that Congress can pass comprehensive housing reform legislation this year.

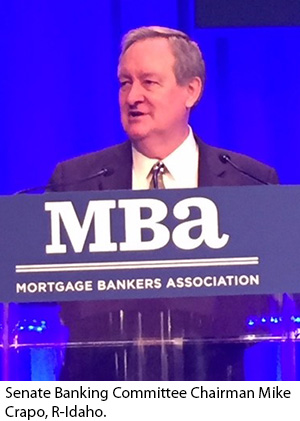

“Comprehensive housing reform remains my highest priority,” said Senate Banking Committee Chairman Mike Crapo, R-Idaho. “While we have bipartisan cooperation on housing reform, we do not have a final solution, but we are working on it.”

Crapo said the Senate and House are capable of moving “quickly” on housing finance reform, but he said the slow pace of action in Congress make it more likely that such legislation continues to face barriers. “I know there is support for Johnson-Crapo,” he said referring to the housing finance reform bill he co-wrote with former Sen. Tim Johnson, D-S.D. “We know there are good proposals out there, like the one that the Mortgage Bankers Association proposed. But the next step is always difficult.”

Crapo said the Senate and House are capable of moving “quickly” on housing finance reform, but he said the slow pace of action in Congress make it more likely that such legislation continues to face barriers. “I know there is support for Johnson-Crapo,” he said referring to the housing finance reform bill he co-wrote with former Sen. Tim Johnson, D-S.D. “We know there are good proposals out there, like the one that the Mortgage Bankers Association proposed. But the next step is always difficult.”

Crapo said he is aware of actions the Trump Administration could take to make some broad secondary market reform happen administratively. “And I am open to that,” he said. “But I have not seen anything from the Administration that suggests this will happen any time soon.”

Crapo did offer praise for S. 2155, the Economic Growth, Regulatory Relief and Consumer Protection Act, of which is he is chief sponsor. The bill includes several MBA-supported priorities, including SAFE Act amendments to provide mortgage loan originators with 120 days of transitional authority to originate when moving from a federal depository to a non-bank (or across state lines); subjecting Property Assessed Clean Lending (PACE) or property retrofit loans to Truth In Lending Act consumer protections; exempting financial institutions originating fewer than 500 closed-end mortgages from Home Mortgage Disclosure Act reporting requirements; and targeted TILA/RESPA Integrated Disclosure fixes.

Crapo called S. 2155 a strong bipartisan bill that had broad Senate support. “That didn’t happen by accident,” he said. “That represented five years of progress representing bipartisan agreement.”

Crapo said the bill is not perfect; he noted that reform of the Consumer Financial Protection Bureau remains untouched thus far. “But I think for the things that you have identified to us, we have made strong progress, and we thank you for your input and support,” he said. “You helped us get it through the Senate, and now you are helping us get it through the House and on the President’s desk.”

Crapo noted the Banking Committee has “broad jurisdiction” over a number of issues, such as flood insurance. “We’ve been deadlocked on this for a long time and there is no sign of breaking the deadlock,” he said. “The National Flood Insurance Program expires again in July, and we are no closer to resolving a long-term resolution to this issue than we were in December,” he said.

Crapo bemoaned the political atmosphere in Washington, calling it “mean and divided.” He noted the nominations of hundreds of presidential appointees, including FHA Commissioner nominee Brian Montgomery, remain in limbo. “We’re not even close to where the previous four presidents in terms of getting people approved for key positions,” he said. “There is a hold on the Montgomery nomination and we are trying to resolve it. There are several hundred nominations on hold and it is a time-consuming process.”

On the other hand, Crapo said over the past 10 years he has argued for conservative causes in Washington and cited two key events: getting Neil Gorsuch on the Supreme Court; and passing comprehensive tax reform. “We’ve also had a significant focus on regulatory reform,” he said. “In addition to fixing our tax code, we really needed to fix our regulatory environment, and that has been a focus on this President and this Congress.”

Crapo said Congress has approved 16 resolutions cutting “baggage and deadwood” regulatory rules, signed by President Trump. “We’ve eliminated 20 bad regulations for every regulation that has been approved, and those that have been approved have been better,” he said.

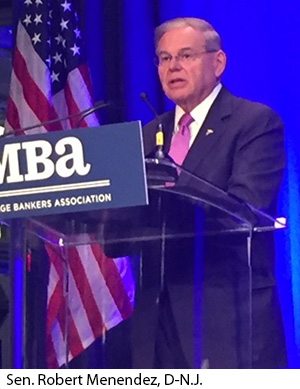

Sen. Bob Menendez, D-N.J., a member of the Banking Committee, said Democrats want reform that does not cause unintended consequences. “From my vantage point, comprehensive legislation must provide a stable backstop for conventional loans,” he said.

Sen. Bob Menendez, D-N.J., a member of the Banking Committee, said Democrats want reform that does not cause unintended consequences. “From my vantage point, comprehensive legislation must provide a stable backstop for conventional loans,” he said.

Menendez said financial reform faces an “uphill battle” in Congress and expressed concerns over efforts to “take an axe to Fannie Mae and Freddie Mac and to provide no government backstop for conventional loans. This is the wrong approach,” he said, adding that any efforts at reform “should strengthen the FHA, not weaken it.”

As a co-sponsor of S. 2155, Menendez authored a provision of the bill that would permit transitional licensing for mortgage loan originators who change jobs or move to different locales. “It’s a common-sense provision,” he said. However, Menendez said he and other Democrats have concerns about provisions in legislation that give larger banks an tilted playing field over smaller mortgage lenders and community banks.

Menendez said looking forward, “we should remember that homeownership is the greatest driver of personal wealth” and that Latinos and other minorities will lead homeownership growth in the next decade. “Policy that promotes homeownership growth is policy worth supporting,” he said.