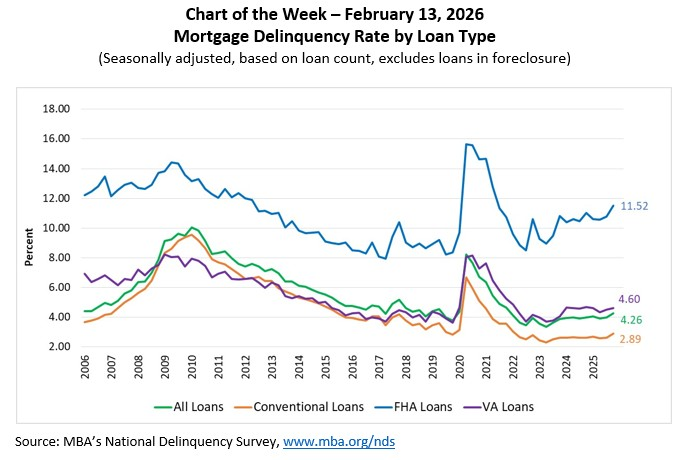

Chart of the Week: Mortgage Delinquency Rate by Loan Type

According to the latest results from MBA’s National Delinquency Survey (NDS), the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.26% of all loans outstanding at the end of the fourth quarter of 2025. The delinquency rate was up 27 basis points from the third quarter of 2025 and up 28 basis points from one year ago. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.53%, up 3 basis points from the third quarter of 2025 and 8 basis points higher than one year ago.

As shown in this week’s Chart of the Week, mortgage delinquencies increased across all three major loan types–Conventional, FHA, and VA–in the last three months of the year. The most pronounced uptick was with FHA loans, which reached a delinquency rate of 11.52%, the highest level since the second quarter of 2021. The FHA foreclosure inventory rate also grew to the highest level since the first quarter of 2020.

The fourth quarter results may have been impacted by the expiration of pandemic-era, FHA relief options, as well as disparities in the labor market–a key determinant of mortgage delinquency levels.

MBA will hold its 2026 Servicing Solutions Conference and Expo Feb. 16-19, in Dallas. The conference will bring together servicing executives, operations managers, service providers, policymakers, and other industry stakeholders. Tune into MBA Research & Economics’ Market Outlook presentation on Wednesday for more details on the state of the mortgage servicing market.

– Anh Doan (adoan@mba.org); Marina Walsh, CMB (mwalsh@mba.org)