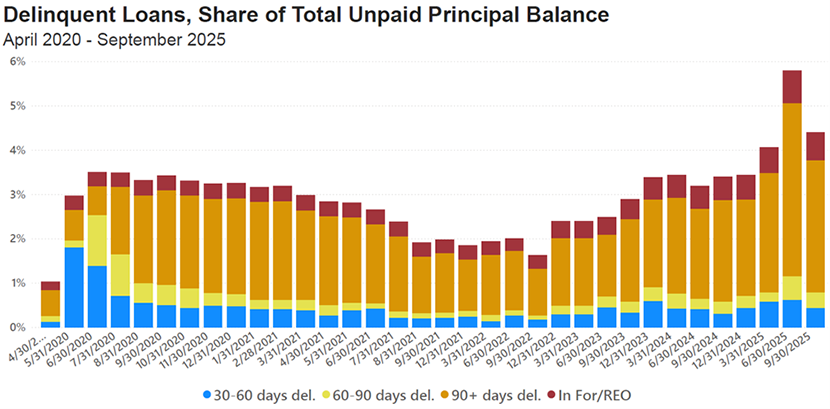

MBA: Delinquency Rates for Commercial Properties Decreased in Third Quarter

Delinquency rates for mortgages backed by commercial properties decreased during the third quarter of 2025. This is according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey.

“After significant increases in delinquency rates in the second quarter, there was a decline in the third quarter,” said Judie Ricks, MBA’s associate vice president of commercial real estate research. “Compared to the first quarter, third-quarter delinquency rates were up, driven by increases in later stage delinquencies and Foreclosure/REO properties. It is worth watching this portion of the market the rest of the year amidst broader economic uncertainty.”

The balance of commercial mortgages that are not current decreased in the third quarter of 2025.

• The share of loans that were delinquent increased for some property types, particularly multifamily and health, decreased for office, retail, industrial and lodging properties.

• Among capital sources, CMBS loan delinquency rates saw the highest levels.

• 5.66% of CMBS loan balances were 30 days or more delinquent, up from 5.14% at the end of last quarter.

• Non-current rates for other capital sources remained moderate.

• 1.45% of life company loan balances were delinquent, down from 1.40%.

• 0.64% of GSE loan balances were delinquent, roughly unchanged from 0.61% the previous quarter.

• 0.79% of FHA multifamily and health care loan balances were delinquent, down from 1.04% the prior quarter.

MBA’s CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of September 30, 2025. This quarter’s results are based on similar surveys conducted since April 2020. Participants reported on $2.8 trillion of loans in September 2025, representing 57 percent of the total $4.9 trillion in commercial and multifamily mortgage debt outstanding (MDO) compared to the Second quarter of 2025 MDO report.

For more information on MBA’s CREF Loan Performance Survey, please click here.