Down Payment Resource: Another Record-Setting Quarter for Homebuyer Assistance

(Image courtesy of Jared VanderMeer/pexels.com)

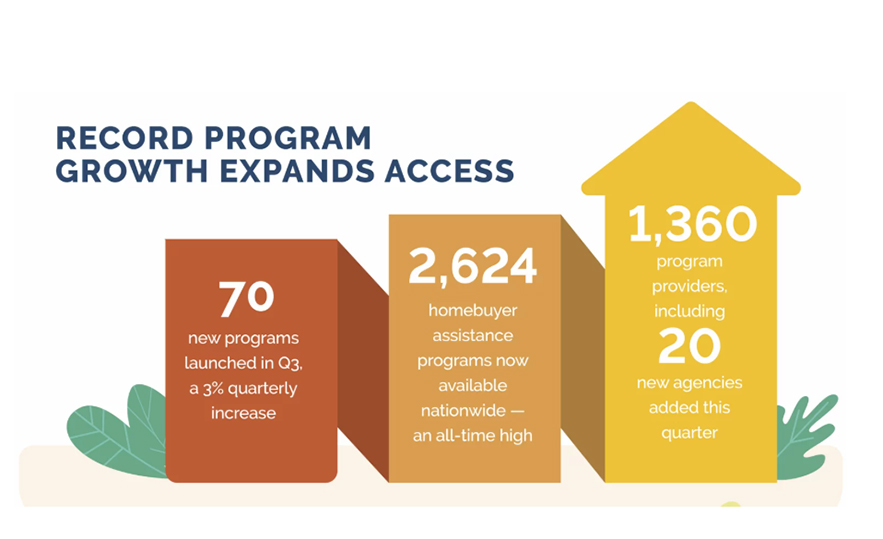

Down Payment Resource, Atlanta, released its Q3 Homeownership Program Index, finding 70 new assistance programs were added during the period.

That brings the nationwide total to 2,624, the highest number DPR has ever recorded.

Twenty new program providers were added, bringing the total of providers to 1,360.

Of the 2,624 programs, 996–or 38%–support repeat buyers. And, 1,628 serve first-time buyers.

Ten percent–or 273 programs–have no income limits, and 32 support first-generation homebuyers.

The vast majority, at 2,110 or 80% of programs, can be used for newly constructed homes.

DPR also noted that support for multifamily purchases is continuing to grow, with 909 programs that allow the purchase of two-to-four unit properties. That’s a 6% increase from Q2.

Programs that support manufactured housing were also up 5%, from 1,006 in Q2 to 1,052 in Q3.

More than half of the programs–at 56%–are structured as second mortgages; most are deferred or forgivable. Ten percent are combined programs, which blend a first mortgage and down payment assistance in the form of a second or grant or both. Nine percent are first-mortgage products. Also, 53% offer full or partial forgiveness over time.

More than 200 offer special incentives based on occupation, service or other characteristics, such as educators (71 programs), Native American buyers (52 programs), law enforcement or emergency medical technicians (50 programs), veterans (49 programs) and active-duty military personnel (38 programs).

Of the 2,624 homebuyer assistance programs, 78% are funded, 11% are inactive, 4% have a waitlist for funding and 6% are temporarily suspended.

“With home prices continuing to rise and mortgage rates still hovering near 6.5%, lenders know how challenging it can be to qualify today’s homebuyers. The good news is that there are now more tools than ever to help,” said Rob Chrane, founder and CEO of DPR. “In Q3 alone, 70 new homebuyer assistance programs were introduced. These resources–available in every U.S. county, with more than 2,000 counties offering 10 or more programs–are helping lenders reduce LTV ratios to qualify more mortgage-ready buyers and close more loans, even in a tight market.”