ACES Quality Management Finds Early Signs of Loan Quality Risk

(Illustration: ACES Quality Management)

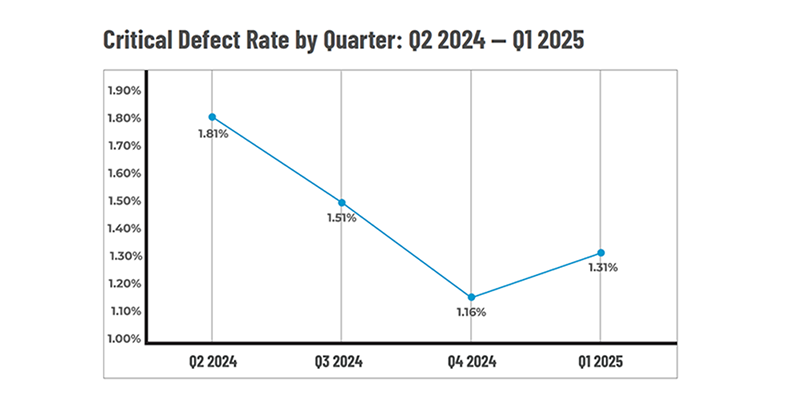

ACES Quality Management, Denver, found the overall critical defect rate rose in the first quarter, ending two quarters of improvement.

The quarterly ACES Mortgage QC Industry Trends Report said the overall critical defect rate rose 12.93% to 1.31%.

ACES noted the defect rate increased from a historic low as underwriting pressures, shifting borrower profiles and market volatility test lenders’ quality control processes.

“The rise in critical defects this quarter underscores how market volatility and operational pressure can impact loan quality,” ACES Quality Management Executive Vice President Nick Volpe said. “At the same time, we’re seeing that lenders who invest in automation and proactive quality control are making measurable improvements, particularly in underwriting and compliance.”

ACES found that Income/Employment defects increased 42.5%, reclaiming the top spot at 22.99% of all critical defects. Borrower and Mortgage Eligibility defects surged 328.57% quarter-over-quarter, while Credit defects rose 11.96%.

USDA loans showed significant improvement, with defect share dropping from 3.23% to 1.06%, ACES reported.

“Assets, Legal/Regulatory/Compliance, and Appraisal categories posted significant improvements,” the report said. “Refinance defect share increased despite a drop in review volume, while purchase defect share declined.”

The report analyzes post-closing quality control data derived from loan files. Defects are categorized using the Fannie Mae loan defect taxonomy. Data analysis for any given quarter does not begin until 90 days after the end of the quarter to allow lenders to complete the post-closing quality control cycle, resulting in a delay between the end of the quarter and ACES’ publication of the data.