ICE Mortgage Monitor: Property Insurance Rates Affecting Trends

(Image courtesy of Luis Yanez/pexels.com)

Intercontinental Exchange Inc., Atlanta, released its March Mortgage Monitor, highlighting the effects of increasing insurance costs on housing trends.

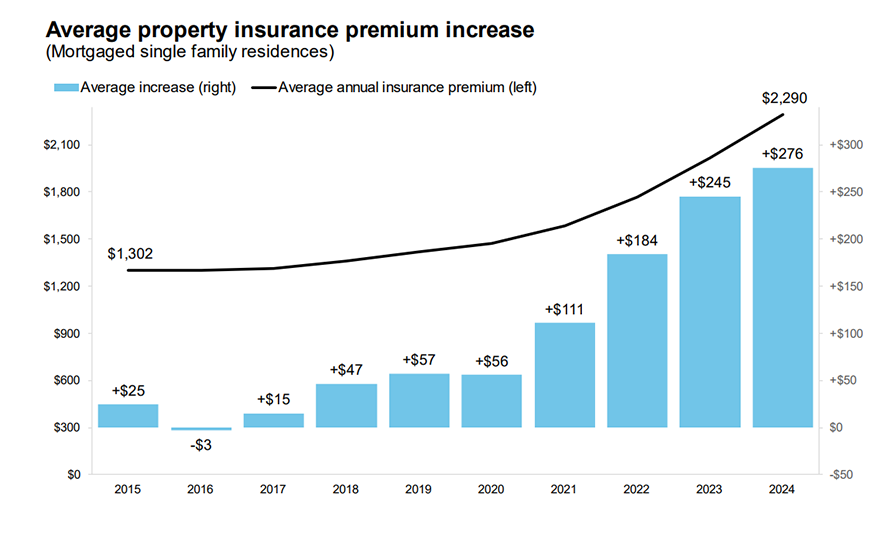

The average annual property insurance premium for mortgaged single-family homes rose by $276 to $2,290. That’s a 14% increase, and up 61% over the past five years.

Seattle, up by 22%, Salt Lake City, also up by 22%, and Los Angeles, up by 20%, saw the largest percentage increases in 2024. The largest increases by dollar amount were Dallas, up by $606, and Houston, up by $515.

Property insurance in Florida has garnered significant attention, and while premiums there didn’t rise as quickly last year, the rates remain among the highest in the country.

“While it’s no surprise that insurance costs are rising, we’re beginning to see emerging trends in terms of how homeowners are responding to the higher cost environment,” said Andy Walden, Head of Mortgage and Housing Market Research for Intercontinental Exchange. “We’re seeing increases in both the share of borrowers switching policies and borrowers taking on higher deductibles as a way to combat rising premiums.”

“ICE loan-level data shows that a record 11.4% of borrowers switched insurance providers in 2024, up from 9.4% in 2023 and less than 8% historically,” Walden added. “While this has undoubtedly been driven by rising non-renewal rates, it may also be a sign of borrowers switching providers in search of lower premiums.”

Homeowners seem to be choosing higher deductibles in order to save, with new borrowers having 19% higher deductibles and 12% lower premiums than the market generally, ICE found.