Realtor.com Finds Just Two Major Metro Areas Where It’s Cheaper to Buy Than Rent

(Image courtesy of Realtor.com; Breakout image courtesy of Max Vakhtbovycn/pexels.com)

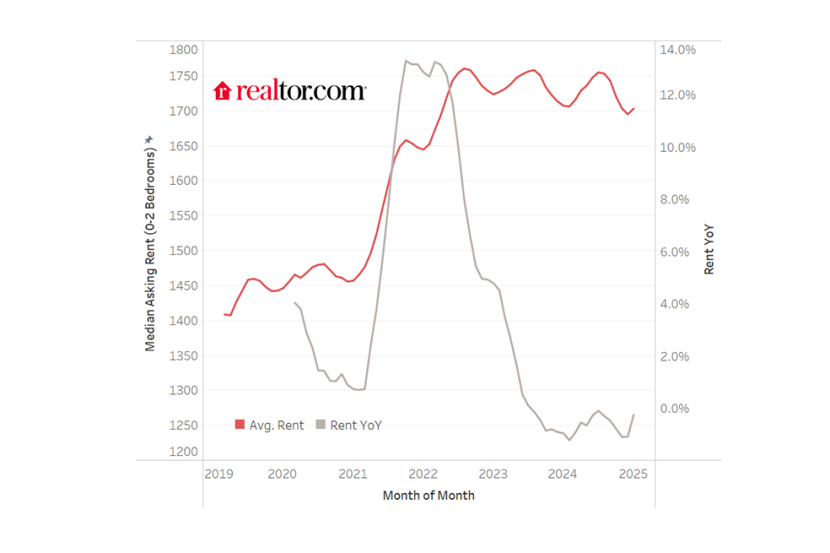

Realtor.com released its January 2025 Rental Report, finding that the median asking rent price across the top 50 metropolitan areas of the U.S. fell year-over-year for the 18th consecutive month.

The median asking rent across the 50 largest metro areas hit $1,703 in January, up from $1,695 in December, but down 0.2% year-over-year.

While rent increases have plateaued somewhat, the median asking rent is still 16.1% above January 2020.

Amid economic uncertainties and rising house prices, Realtor.com also pinpointed the only metro areas where it’s currently cheaper to buy than rent for the median earner–Pittsburgh and Detroit. In contrast, there were six metro areas with that status this time last year.

Those are also the two major metro areas with the lowest median listing prices; Pittsburgh’s median price is $229,700 and Detroit’s is $239,950. In contrast, Pittsburgh has the No. 16 lowest median rent and Detroit’s is No. 10.

However, there are a number of metro areas that are becoming more renter-friendly and less buyer-friendly, including Baltimore, Boston, Charlotte, N.C., Chicago and Houston.

“For most Americans owning a home is still a big part of the American Dream, yet the lower monthly costs of renting in all but 2 of the 50 largest markets are a key consideration,” said Danielle Hale, Chief Economist, Realtor.com. “This relative cost advantage is one of the reasons we expect an increase in renter households and declines in the homeownership rate in 2025.”

By unit size, studio rents have grown the least over the past five years–since the onset of the COVID-19 pandemic. The rent for studios in January was $1,423, up just 11.4% from January 2020.

Rents fell for 1- and 2-bedrooms from January 2024, but those types of units have also seen 16% and 20% growth, respectively, compared with January 2020.