Christine Chandler: For Servicers, Challenges, Opportunities Abound

DALLAS–Christine Chandler, 2025 Mortgage Bankers Association Chair-Elect and Chief Credit Officer and Chief Operating Officer at M&T Realty Capital Corp., discussed hot topics in the servicing industry–including natural disasters, insurance costs and policy challenges–during her opening remarks at MBA’s 2025 Servicing Solutions Conference & Expo.

Broeksmit: A New Era of Opportunity

SAN DIEGO–The landscape in Washington, D.C. is changing, and MBA views it as a “new era of opportunity,” said MBA President and CEO Bob Broeksmit, CMB, here at the MBA Commercial/Multifamily Finance Convention and Expo.

MBA: Mortgage Delinquencies Increase in Fourth-Quarter 2024

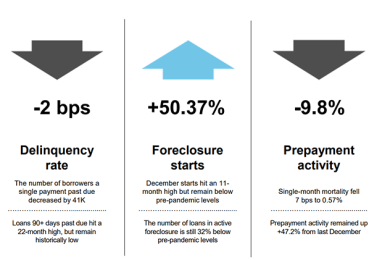

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.98% of all loans outstanding at the end of the fourth quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.

Servicing Panel Talks AI, Insurance, Future Trends

DALLAS–What’s next for the servicing industry when it comes to trends and challenges in technology, regulation and the overall market?

What’s Next in Washington? Industry Leaders Weigh In

DALLAS–“From HUD to CFPB to the chairs of key committees on Capitol Hill, MBA is bracing for big change,” said Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, in a session on post-election analysis at MBA’s 2025 Servicing Solutions Conference & Expo.

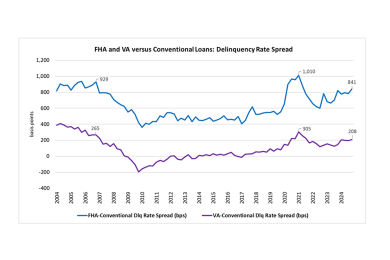

ICE: 2024 Saw Softest Home Price Growth in Years; Mortgage Delinquencies Trending Higher

Home prices ended the year on an up note, but 2024 was the softest year for home price growth in more than a decade, according to Intercontinental Exchange.

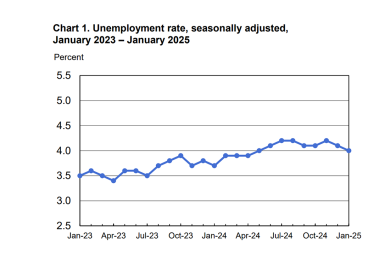

143,000 Jobs Added in January, Unemployment Rate Edges Down

There were 143,000 jobs added to total nonfarm payroll employment in January, the Bureau of Labor Statistics reported Feb. 7.