CoreLogic: Investor Share Likely to Remain Roughly Quarter of Total Sales

(Image courtesy of CoreLogic)

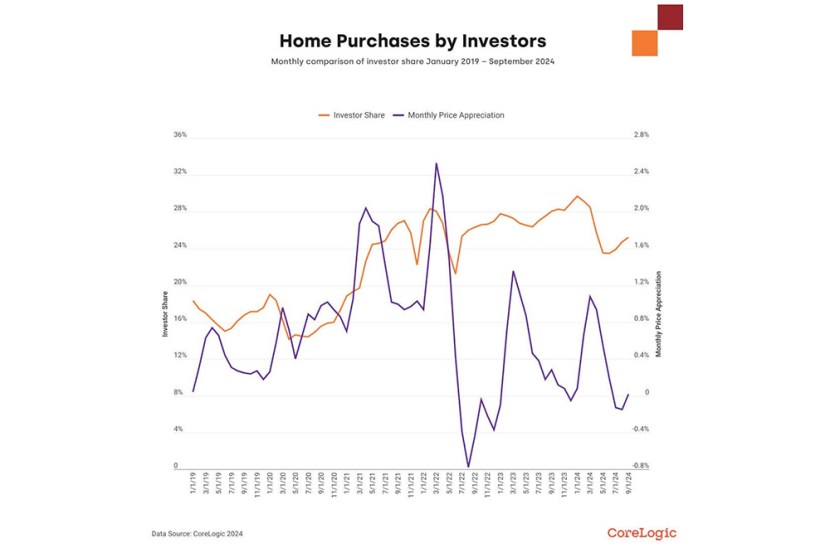

CoreLogic, Irvine, Calif., released its report on Q3 2024 investor activity on home purchases, finding a small uptick from mid-year numbers.

This slow growth trend is expected to hold, CoreLogic said, and signs point to investor share remaining around 25% of total sales for the foreseeable future as mortgage rates and home prices both remain high.

Investor share of single-family home purchases hit a high of 30% in January 2024, and Q3’s 25% is down from last year’s 28%. In Q3, investors averaged 21,000 purchases per month fewer than in Q3 2023.

Mom-and-pop investors make up about 60% of investor purchases. CoreLogic defines these investors as those with three to 10 properties.

In general, investors in Q3 preferred low-priced homes, likely to attract renters. However, there’s a lot of competition for those properties, including buyers seeking their first homes.

The most popular metro areas for investors to purchase homes are currently Dallas and Houston, with Atlanta, Los Angeles and Phoenix rounding out the top five.

There were few areas that saw an increase in investor share between Q3 2023 and Q3 2024, but those that did include South Dakota, Oregon and Washington, D.C.

Some markets saw notable declines, however. In Idaho, investor share fell 5.7%. Montana saw a 5.3% drop and Maryland saw 5.1%. Many markets in the Northeast, Upper Midwest and the West Coast saw declines between 0-2%.