Clever Real Estate: Renting More Affordable Than Buying in Almost All Major Cities

(Image courtesy of Clever Real Estate)

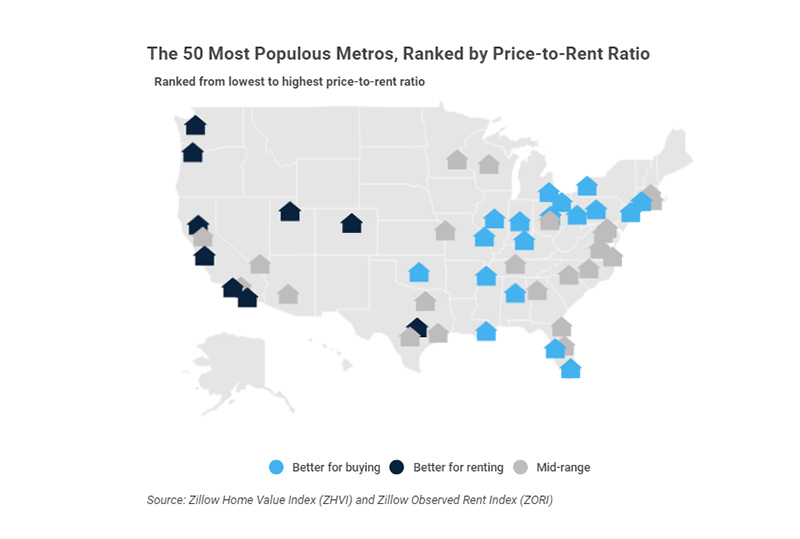

Clever Real Estate, St. Louis, found that on a monthly basis, rent costs are cheaper than homebuyers’ payments in 96% of major U.S. cities.

The analysis compares principal, interest, taxes and home insurance payments vs. rent to create a price-to-rent ratio.

In only two cities did homeownership come out cheaper: Cleveland and Pittsburgh.

Cleveland was the cheapest–the typical monthly housing payment for an owner is $1,331, compared with $1,426 for rent. In Pittsburgh, the typical monthly housing payment is $1,437 and the typical monthly rent payment $1,461.

Also in the top five–although with cheaper rent than housing payments–are Memphis, Tenn., ($1,515 in housing vs. $1,471 in rent); Birmingham, Ala., ($1,497 in housing vs. $1,452 in rent); and Indianapolis, Ind., ($1,706 in housing vs. $1,589 in rent.)

The largest disparity for homebuyers was San Jose, Calif., where a homebuyer’s typical monthly expense is $8,943, but rent is $3,346.

Also in the top five most expensive are San Francisco ($6,770 in housing vs. $3,086 in rent); Los Angeles ($5,558 in housing vs. $2,942 in rent); San Diego ($5,266 in housing vs. $3,039 in rent); and Seattle ($4,245 in housing vs. $2,241 in rent.)

Nationwide, the typical renter saves $289 more than homeowners each month.