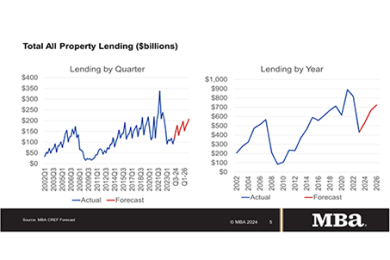

MBA Forecast: Commercial/Multifamily Borrowing and Lending to Increase 26% to $539 Billion in 2024

Total commercial and multifamily mortgage borrowing and lending is expected to finish the year at $539 billion, which is a 26% increase from 2023’s total of $429 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association.

CREF Policy Update: FHFA Proposes GSE Multifamily Housing Goals for 2025-2027

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CoreLogic: Single-Family Rents Continue to Grow in June

CoreLogic, Irvine, Calif., reported single-family rental prices increased 2.9% year-over-year in June, similar to gains notched the month before.

KBRA Says CMBS Appraisal Reductions Are Climbing

Kroll Bond Rating Agency, New York, reported that commercial mortgage-backed securities appraisal reduction amounts–ARAs–have climbed in tandem with delinquency rates.

CBRE: North American Data Center Vacancy Rates at Record Low Despite Booming Supply

CBRE, Dallas, found North American data center supply grew strongly in the first half of 2024, but availability continued to tighten as demand related to cloud computing and artificial intelligence more than offset the new supply.

Fitch Ratings Finds Commercial Mortgage REITs Pressured by Weakening Credit Quality

Credit quality at commercial mortgage real estate investment trusts deteriorated in the first half of 2024 according to Fitch Ratings, New York.

Dealmaker: JLL Secures $234M in Construction Financing in Naples, Fla.

JLL Capital Markets, Chicago, arranged $234 million in construction financing for Rosewood Residences Naples, a 42-unit beachfront condominium development in Naples, Fla.