MBA Honors 2024 NewsLink Tech All-Stars

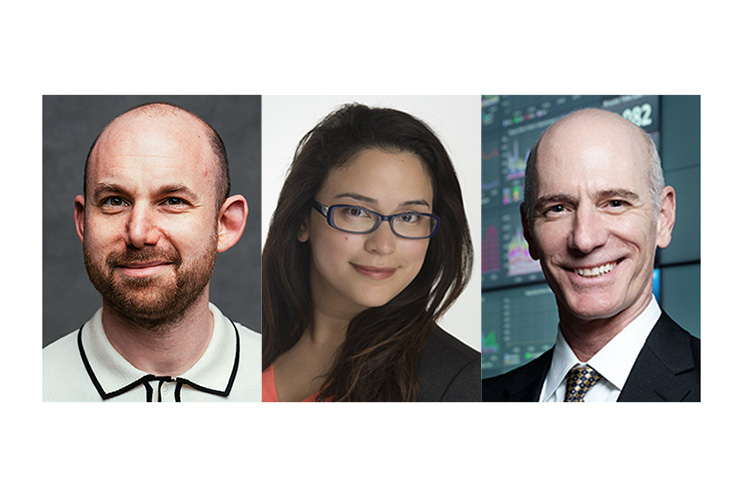

(From left: Shmulik Fishman, Karol Villavicencio and Dominic Iannitti)

SAN FRANCISCO–The Mortgage Bankers Association awarded the MBA NewsLink Tech All-Star Award on Tuesday to three visionary leaders in the mortgage technology industry.

This year’s honorees are Karol Villavicencio, Director of RegCheck Operations and Product Management for Asurity, Washington, D.C., Shmulik Fishman, CEO & Founder of Argyle, New York, and Dominic Iannitti, President and CEO at DocMagic, Inc., Torrance, Calif.

“Gaining efficiency and economies of scale is important at any time but especially in today’s market” said Rick Hill, MBA Vice President of Industry Technology. “MBA’s 2024 Tech All-Star award winners have developed creative solutions that automate key processes within our industry, enabling companies to do more with less. They are very deserving of being recognized as All Stars.”

Villavicencio, Fishman and Iannitti were honored on Tuesday at the MISMO Spring Summit in San Francisco.

Since 2002, the MBA NewsLink Tech All-Star Awards have celebrated industry leaders who have made outstanding contributions in mortgage technology.

Karol Villavicencio, Asurity

Karol Villavicencio, Director of RegCheck Operations and Product Management for Asurity, is the product owner from ideation to implementation for Asurity’s automated compliance solution, RegCheck. She serves as a subject matter expert for much of the legislation, document requirements, technologies and data standards that lenders rely on to make RegCheck work.

Villavicencio’s drive to improve the compliance landscape propelled her to become involved with the MISMO Regulatory Compliance Examination File Workgroup. Through her work with the committee, she’s emerged as a strong advocate for lenders, servicers, vendors and regulators, who all benefit from clear standards and guidance when it comes to compliance.

Shmulik Fishman, Argyle

Serial entrepreneur–serial-prenuer–Shmulik Fishman started Argyle in 2018 to address a well-known mortgage industry pain point: documenting a loan applicant’s income and employment status. Legacy verification providers report success rates ranging from 20-30%, cost about $100 per report, and once 30 days have elapsed, the data is considered stale and lenders are often charged extra to re-verify borrower information before closing. Worse, legacy providers haven’t evolved to meet the needs of today’s workforce, which increasingly includes side gig and self-employed workers.

Argyle has amassed income and employment data coverage superior to the three largest credit bureaus, offering hit rates four to five times higher than legacy data providers at a lower cost.

In addition, Argyle customers have to intervene manually less often and can process and underwrite loans faster, Fishman noted.

Dominic Iannitti, DocMagic, Inc.

Dominic Iannitti came up with the business plan for DocMagic, Inc. as a college student at Long Beach State in California. He founded the company in 1987 with a clear goal: to utilize technology to reduce the volume of paper throughout the loan document preparation process.

DocMagic’s products now cover a wide range of mortgage-related services and solutions. For his contribution to the industry based on that goal–particularly as it pertains to his work on various “e” products–Iannitti is an MBA NewsLink 2024 Tech All-Star Award recipient.