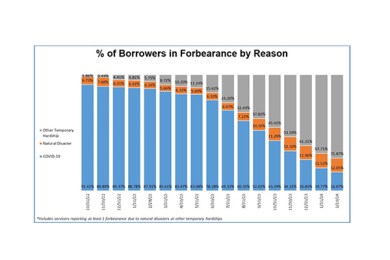

MBA Reports Share of Mortgage Loans in Forbearance Holds Steady at 0.22% in February

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained unchanged at 0.22% as of Feb. 29, 2024.

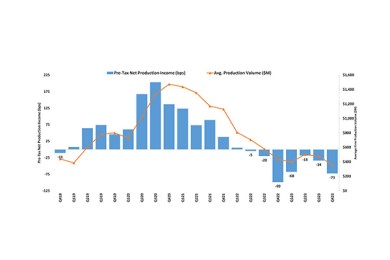

MBA: Commercial and Multifamily Mortgage Delinquency Rates Increased in Fourth Quarter 2023

Commercial mortgage delinquencies increased in the fourth quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

February Foreclosure Activity Up From Last Year, ATTOM Finds

ATTOM, Irvine, Calif. reported U.S. foreclosure activity increased 8% year-over-year in February, but fell 1% from the previous month.

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased in Fourth Quarter

The level of commercial and multifamily mortgage debt outstanding at the end of 2023 was $130 billion (2.8%) higher than at the end of 2022, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

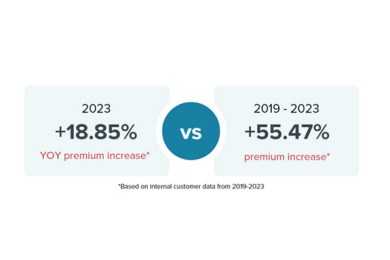

Guaranteed Rate: Home Insurance Prices Up 19% in 2023

Guaranteed Rate Insurance, Chicago, released a proprietary homeowners insurance study, finding home insurance prices increased 19% from first-half 2022 to first-half 2023 and 55% since 2019.

Fitch Ratings: Mortgage Insurer Ratings Reflect Strong Borrower Credit Performance

Fitch Ratings, New York, said underwriting results for U.S. mortgage insurers remained very strong through 2023.