CBRE: Multifamily Rent Growth Slows in Q3

(Image courtesy of CBRE)

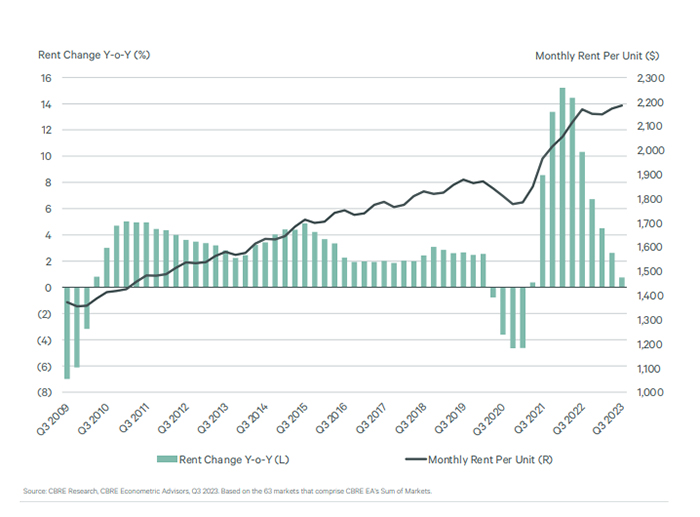

CBRE, Dallas, found that average multifamily rent growth slowed to 0.7% year-over-year in the third quarter amid an influx of deliveries of new units.

The small increase is a large contrast from the record, 15.2%, set in the first quarter of 2022.

Quarter-over-quarter, the average monthly rent was up 0.6%, but still at a record high of $2,184.

CBRE linked those new units on the market to the slowdown in rent growth, noting markets with the most construction deliveries saw the biggest declines in growth.

There were 114,600 new deliveries in the quarter, boosting the trailing four-quarter total to 376,500. There was net absorption of 82,100 units in Q3.

However, there have been fewer construction starts in recent quarters, which will lower deliveries in 2025 and following years.

“Renter demand remained healthy through the third quarter, largely offsetting record new construction,” said Kelli Carhart, leader of Multifamily Capital Markets for CBRE. “We anticipate investment activity to pick up mid-2024, driven by an end to the Fed’s rate hiking cycle and improved capital markets conditions, as well as loan maturities that will create transaction opportunities.”

The overall multifamily vacancy rate increased by 10 basis points to 5.1%, slightly above the long-term average of 5%. For the first time in a year, no markets tracked by CBRE had a vacancy rate of less than 2%.

Multifamily investment dropped by 8.5% quarter-over-quarter, but was 6% above the first quarter. The multifamily sector was the largest chunk, at 34% of total commercial real estate investment volume.