DBRS Morningstar Warns About Insurance and Property Values in Coastal Areas

(Image courtesy DBRS Morningstar)

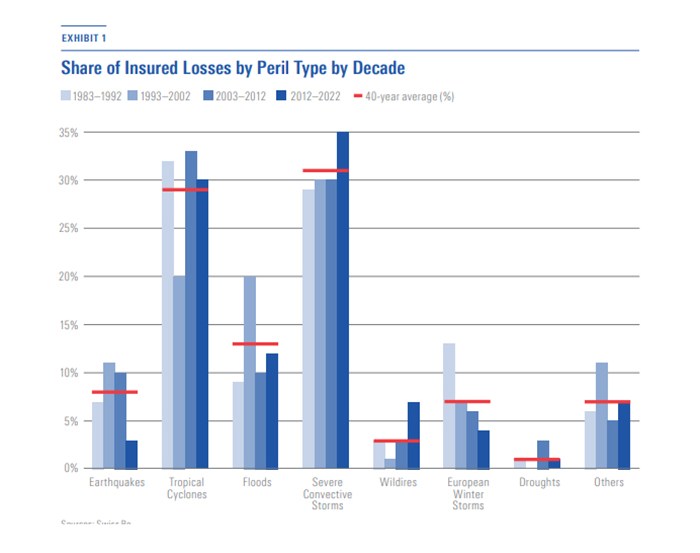

DBRS Morningstar, Toronto, released a new analysis warning about the impacts of climate change–including hurricanes–on property insurance in vulnerable areas. Insurance companies are exiting catastrophe-prone areas, DBRS Morningstar said, potentially leading to a decline in property values.

One issue with catastrophe-prone areas in the United States, the analysis noted, is that population growth and migration patterns are increasing their residents. Per the National Oceanic and Atmospheric Administration, 40% of the U.S. population now lives along the coast.

Homes in those areas have also seen price increases, among other factors, driving up insurance costs, and some insurance companies have stopped offering coverage in states such as Florida, California and Louisiana.

DBRS Morningstar predicted an increased reliance on government insurance programs will continue to grow. “As of 2020, homeowners living in Florida accounted for the majority of insurance policies issued by the [National Flood Insurance Program], as traditional home insurance policies typically do not cover flood risk, a major cause of damage along the coast due to storm surge,” the analysis noted.

If homeowners can’t secure insurance, real estate values may decline in those communities.

“U.S. states along the Atlantic coast, in particular, should expect turbulent times ahead as it is almost certain they will experience at least one major storm every year during hurricane season,” the commentary stated. “We do not foresee any immediate rating implications because of the exit of insurers from the affected regions. However, individual properties/ transactions could be affected if property prices decline because of expensive or unavailable insurance coverage.”