Many Americans Misinformed About Home Buying, Survey Says

(Image courtesy Real Estate Witch/Clever Real Estate)

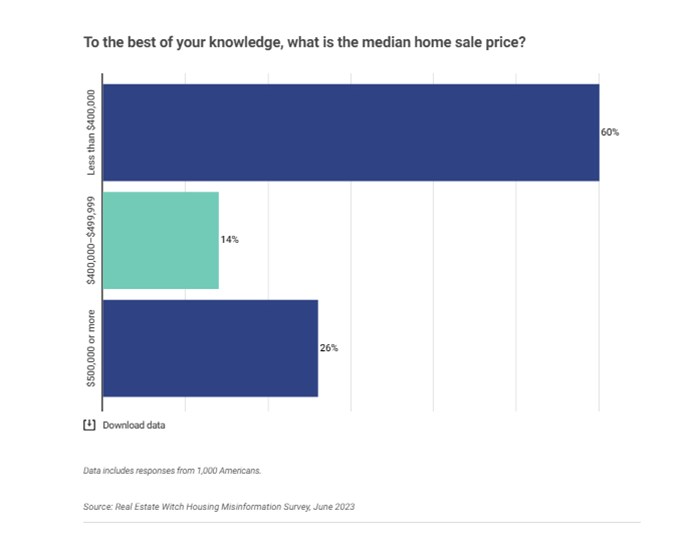

Only 14% of Americans surveyed know the current median house price range, and just 12% know the current interest rate for a 30-year mortgage, a publication owned by Clever Real Estate found in a survey.

The survey identified some issues, such as that 73% of Americans don’t believe houses are currently affordable, but 60% believe the median sales price is lower than it actually is. Moreover, 76% of non-homeowners report being concerned about rising home prices.

Thirty-one percent of non-homeowners say they’re knowledgeable about home-buying, with 43% saying they’re knowledgeable about mortgages. However, 62% incorrectly believe individuals are required to put down 20% in order to purchase a home, and 21% believe the required down payment is even higher.

Of the survey respondents, 85% don’t know what private mortgage insurance is, and 32% say a credit score of at least 700 is necessary to purchase a home.

The survey also found misinformation among how real estate agents are paid, and the average age at which people become first-time buyers.

Ultimately the survey, conducted by Clever Real Estate’s subsidiary Real Estate Witch, found 83% of homeowners were surprised by parts of the home-buying process, with 65% adjusting their budgets and 63% adjusting priorities.