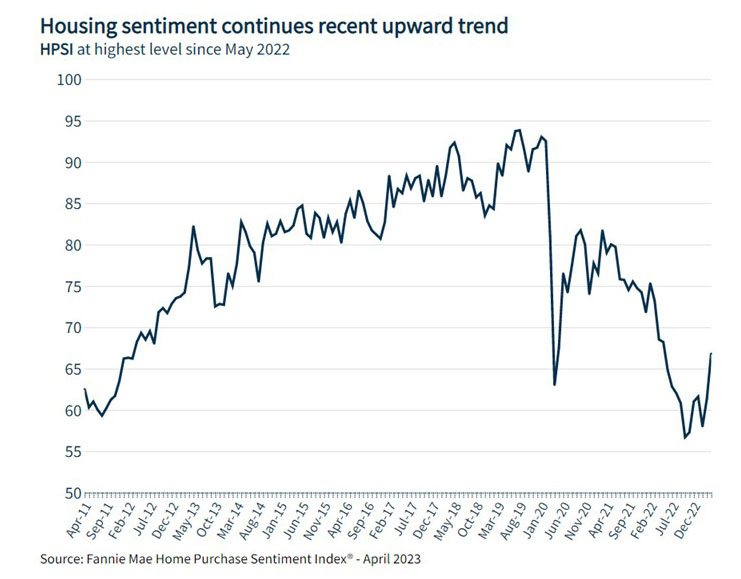

Fannie Mae: Housing Confidence at 12-Month High

Fannie Mae, Washington, D.C., reported its Home Purchase Sentiment Index increased in April to its highest level since May 2022, jumping 5.5 points to 66.8.

All six components increased month over month, most notably the component associated with consumers’ expectations of mortgage rates. While the component remains negative on net – meaning more respondents than not expect mortgage rates to go up over the next year – in April, 22% of consumers indicated that they expect mortgage rates to go down, compared to only 12% last month.

Affordability constraints continue to hinder overall homebuying sentiment, with only 23% of respondents indicating it’s a good time to buy a home, although a plurality once again believe that home prices will increase over the next 12 months. Year over year, the full index is down 1.7 points.

“This month’s increase in the HPSI was the largest in over two years, primarily driven by consumers’ more optimistic mortgage rate expectations,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “An increased number of respondents indicated they think mortgage rates will go down over the next year, a belief that could be due to a combination of factors, including an awareness of decelerating inflation, market suggestions that monetary conditions will ease in the not-too-distant future, and, of course, actual mortgage rate declines during the month.”

Duncan cautioned, however, the bump in optimism could prove to be temporary, as consumers continue to report uncertainty about the direction of home prices. “Until affordability improves for a larger swath of the homebuying public, we believe home sales will remain subdued compared to previous years,” he said.

Other report findings:

–Respondents who say it is a good time to buy a home increased from 20% to 23%, while the percentage who say it is a bad time to buy decreased from 79% to 77%.

–Respondents who say it is a good time to sell a home increased from 58% to 62%, while the percentage who say it’s a bad time to sell decreased from 40% to 38%.

–Respondents who say home prices will go up in the next 12 months increased from 32% to 37%, while the percentage who say home prices will go down increased from 31% to 32%. The share who think home prices will stay the same decreased from 35% to 31%.

–Respondents who say mortgage rates will go down in the next 12 months increased from 12% to 22%, while the percentage who expect mortgage rates to go up decreased from 51% to 47%. The share who think mortgage rates will stay the same decreased from 34% to 31%.

–Respondents who say they are not concerned about losing their job in the next 12 months increased from 78% to 79%, while the percentage who say they are concerned remained unchanged at 21%.

–Respondents who say their household income is significantly higher than it was 12 months ago increased from 20% to 24%, while the percentage who say their household income is significantly lower remained unchanged at 11%. The percentage who say their household income is about the same decreased from 68% to 64%.