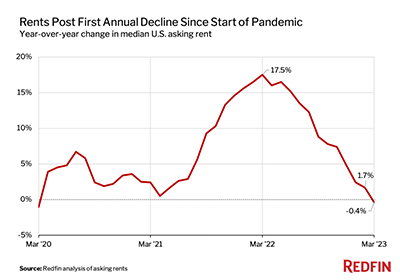

Apartment Rents Post First Annual Decline in Three Years

The median U.S. apartment asking rent fell slightly in March and the rental component of the Consumer Price Index has leveled off, two new reports said.

Redfin, Seattle, reported apartment asking rents fell 0.4% year-over-year in March to $1,937–the first annual decline since March 2020 and the lowest median asking rent in 13 months. By comparison, rents were up 17.5% one year earlier, in March 2022.

ApartmentList, San Francisco, found the year-over-year growth rate of CPI’s rent component has leveled off, coming in at 8.8 percent in March, flat from February. The apartment rent national rent index is currently up by just 2.6 percent year-over-year, a significant drop from the “staggering” 18 percent peak seen in December 2021, ApartmentList said.

“Rents are falling, but it feels more like they’re just returning to normal, which is healthy to some degree,” said Dan Close, a Redfin real estate agent in Chicago, where the median asking rent in March was 9.2% lower than a year earlier. He compared apartment rents to the price of eggs. “You can say egg prices are plummeting, but what’s really happening is they’re finally making their way back to the $3 norm instead of $5 or $6. Rents ballooned during the pandemic, and are now returning to earth.”

Redfin noted rents surged during the past two years because incomes increased and household formation rose as more millennials started families. “But household formation is now slowing, partly because many people are opting to stay put rather than move during a time of economic uncertainty,” the report said.

Rents declined from a year earlier in March largely due to a supply surplus due to the pandemic homebuilding boom, Redfin said. The number of multifamily units under construction and the number completed each rose to the second-highest level in more than three decades in February. Completed residential projects in buildings with five or more units jumped 72% year over year on a seasonally adjusted basis to 509,000, the highest level since 1987 except for February 2019.

“The overall rental market is also cooling because still-high rental costs, inflation, rising unemployment and recession fears are causing rental demand to ease,” Redfin said. “Rental vacancies are on the rise, prompting some landlords to cut rents and/or offer concessions like discounted parking.” Rents declined in 13 major U.S. metros, including Austin, Texas (-11%), Chicago (-9.2%), New Orleans (-3%) and Cincinnati. Other cities including Raleigh, N.C. and Cleveland saw significant apartment rent increases of 16.6% and 15.3%, respectively, Redfin reported.