Educated Millennials Hold Key to Future Homeownership Demand

First American Financial Corp., Santa Ana, Calif., said in challenging housing market conditions with higher interest rates, certain fundamentals will drive future growth. One such driver, said First American Deputy Chief Economist Odeta Kushi, is level of education.

And Kushi notes that if increased earning potential from education translates to a greater likelihood of becoming a homeowner, then millennials are on the right track. She writes the millennial generation, (ages 26 and 41) is the largest living adult generation.

“Many millennials are well into their careers, while others are still in school,” Kushi said. “Millennials are the most educated generation in American history. Approximately 38 percent of millennials have a bachelor’s degree or higher, compared with 32 percent of Generation X and 15 percent of baby boomers when they were the same age. Millennials also earned their bachelor’s degrees much faster than previous generations. By their mid-40s, 30 percent of baby boomers had a bachelor’s degree or higher, Generation X reached that mark by their late 20s, but millennials achieved the same educational milestone by their mid-20s.

However, education takes time and money, Kushi said. “Millennials have delayed key lifestyle decisions in favor of investing in the pursuit of education, pushing marriage and family formation to their early-to-mid-30s,” she said. “Previous generations made these lifestyle choices in their 20s. Marriage and family formation are two of the most powerful motivations for homeownership, so these delayed lifestyle choices tend to also delay the desire for homeownership. However, when the time comes to become a homeowner, the earning power benefits of higher educational attainment are real.”

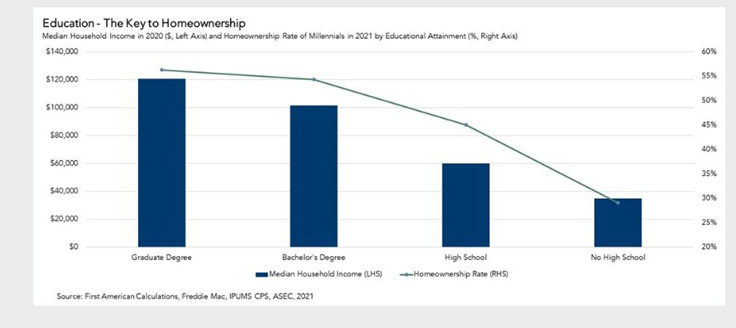

Ultimately, Kushi said, the investment in education pays off. First American research shows in 2020, millennials with a bachelor’s degree had a median household income of more than $100,000, while those with at least a graduate degree had a median household income of more than $120,000. Compare those income levels with the median household income of millennials with just a high school degree (or some college) of $60,000, she said, and the earning power benefits of higher education are undeniable. The income difference is even more stark when compared with millennials with no high school degree, who have a median household income of $35,000, further underscoring the importance of and connection between educational achievement and earning power.

First American also reported higher household income has positive implications for house-buying power, and the likelihood of purchasing a home. The homeownership rate for millennials with a bachelor’s degree in 2021 was 9 percentage points higher than those with just a high school degree.

“Nevertheless, we know that millennials have a lower homeownership rate compared with their generational predecessors,” Kushi said. “At age 30, 42 percent of millennials owned homes, compared with 48 percent of Gen Xers at the same age. Yet, millennials have significantly narrowed this gap as they move into a new phase of their lives. At the same age of 40, the millennial homeownership rate is 60.3 percent, while Gen X stood at 63.5 percent.”

Those percentages are expected to increase, Kushi said. “The importance of education to homeownership continues to increase over time. The impact of educational attainment on the likelihood of homeownership has more than doubled in 20 years. In 2000, the difference in the homeownership rate between those with a high school degree and those with a college degree was 3.7 percentage point. By 2021, this gap more than doubled to 7.5 percentage points. Millennials pursuit of higher education is good news for the housing market in the long run, because education is the key to unlock both greater earning power and, in turn, homeownership.”