Retail Sector Benefits from Job Growth

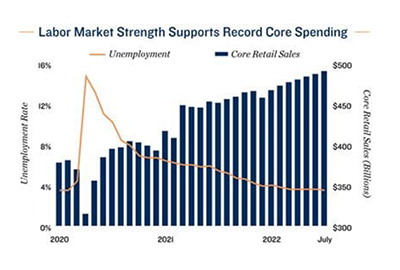

The retail sector is reaping the benefits of recent strong job growth, reported Marcus & Millichap, Calabasas, Calif.

In a Research Brief, Marcus & Millichap said addition of 528,000 new jobs nationwide in July pushed the U.S. employment base beyond the pre-pandemic level.

“[Retail] property metrics reflect solid space demand,” Marcus & Millichap said. “A record job count and historic core spending are encouraging vendor expansions.” During the 12-month interval that ended in June, absorption more than tripled new deliveries, pushing retail vacancy down to 4.9 percent, identical to year-end 2019.

“Entering July, availability was below the nationwide average in 23 major markets, including numerous Florida and other Sun Belt locales,” Marcus & Millichap said. “Across these metros, absorption may outpace completions over the near term as continued population growth heightens demand for local retailers.”

Recent investment activity suggests investor confidence in the sector’s future performance is widespread, Marcus & Millichap reported. “Spanning small to large markets, deal flow rose by at least 40 percent over the year-long period ended in June, led by sales velocity in secondary metros,” the report said. “Though trading showed signs of moderation in the second quarter, the number of closings was on par with the prior five-year quarterly average, an encouraging sign amid rising interest rates and more stringent underwriting.”

Nicole Larson, Research Analyst with Colliers International, Toronto, said general retail and neighborhood centers benefited from strong growth in demand from restaurants, grocers, discounters and big-box retailers in the second quarter, leading to 19 million square feet of space being absorbed. In a Knowledge Leader report, she said retailers signed nearly 19,000 individual leases spanning 64.3 million square feet, “and leasing activity continues to improve as retailers open more stores, with growth being driven by the demand for smaller spaces.” The national retail vacancy rate dropped ten basis points during the second quarter to 4.4%, she said.

“Landlords have been reporting more substantial pricing power, while positive momentum in real estate investment trust leasing spreads is signaling additional growth is likely on the horizon,” Larson said. “Retail owners in strong locations will likely be able to beat inflation as leases roll, and tightening economic fundamentals are expected to push rents higher throughout the second half of the year.”