MBA Chart of the Week: Performance of Post-Forbearance Loan Workouts

According to MBA’s Monthly Loan Monitoring Survey, the share of loans in forbearance dropped slightly to 0.81 percent of servicers’ portfolio volume as of June 30, from 0.85 percent the prior month. Only about 404,000 homeowners are still in forbearance plans, after reaching a peak of nearly 4.3 million homeowners in May 2020. Many of the homeowners that exited forbearance over the past two years entered into a post-forbearance loan workout – either a repayment plan, a stand-alone payment deferral/partial claim or loan modification.

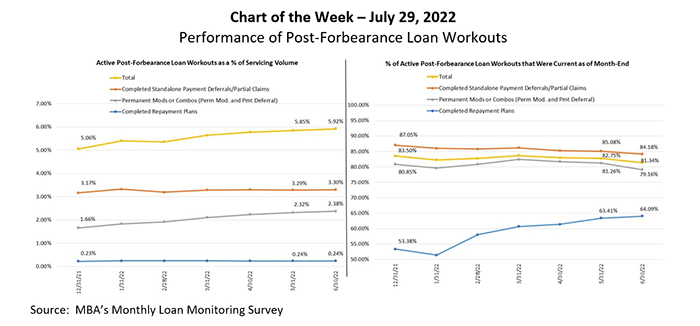

This week’s MBA Chart of the Week shows the percentage of active loans that are in a post-forbearance loan workout, and the performance of these workouts since the start of the year. About 5.92% of serviced loans (2.96 million homeowners) were in a post-forbearance workout as of June 30. The workouts were almost exclusively stand-alone payment deferrals and modifications, with repayment plans representing only 0.24% of servicing volume. During this six-month period, the performance of these workouts has been relatively strong, with 82.76% (more than 4 out of 5 homeowners) making their scheduled payments. This coincides with an overall servicing portfolio performance rate that averaged 95.34% current in the first half of the year.

There are some recent early indicators of possible borrower stress resulting from high inflation and rising interest rates, among other factors. For example, the performance of post-forbearance workouts in June declined to 81.34% current, which is 141 basis points lower than the previous month and 216 basis points lower than the beginning of the year. It is worth monitoring post-forbearance workouts – particularly for borrowers with government loans, who are typically the most vulnerable to economic slowdowns.

Definitional Notes on Post-Forbearance Workouts:

- Repayment Plan: Past due amounts are added on to existing mortgage payments over several months, in order to bring the existing mortgage current. As a result, borrower monthly payments to servicer may increase from pre-pandemic payment levels until past due amounts fully paid.

- Payment Deferral/Partial Claim: Payments that were not made by the borrower are moved to the end of the loan term to be paid upon home sale, refinance or at maturity. This allows the borrower to resume making their regular monthly payments as before, without needing to “catch up” on missed payments.

- Modification or Combo (Modification and Payment Deferral): A permanent change is made to the terms of an existing loan in order to make monthly payments more affordable and allow the homeowner to stay in their home. It may involve a reduction in the interest rate, an extension of the length of time for repayment and/or a different type of loan or loans.

–Marina Walsh, CMB mwalsh@mba.org; Jonathan Penniman jpenniman@mba.org.