KBRA: Servicers Performed Admirably During COVID

Kroll Bond Rating Agency, New York, said commercial mortgage-backed securities servicers “performed admirably” over the last two years while facing nearly unprecedented distress during the COVID pandemic.

“Master and special servicers worked together to respond in a manner that allowed for short-term borrower relief in an economy that saw a 32.9% decline in GDP in the early months of the pandemic,” KBRA said in a new report, CMBS Servicing and Modifications During COVID: A Two-Year View.

“In fact, by loan count, almost two-thirds of the modifications performed after the start of the pandemic were effectuated without having the loan being transferred to the special servicer,” the report said. “This was not common in CMBS before COVID. A positive impact of this approach was limiting special servicing fees that would have otherwise been borne by the borrower and/or certificateholders, as well as staving off defaults and losses. For loans that did ultimately transfer to the special servicer, nearly 50% have been corrected and returned to the master servicer.”

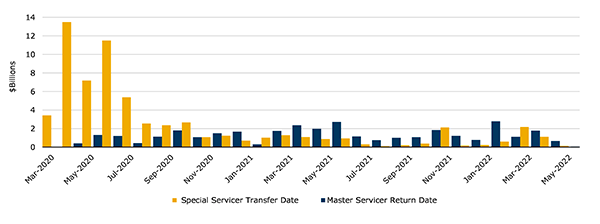

KBRA analyzed nearly 20,000 loans totaling $491.6 billion in principal balance across CMBS 2.0 transactions that were outstanding as of March 2020. The study period covered March 2020 to May 2022. KBRA relied on the special servicer transfer date, master servicer return date, and date of last modification as reported in the CRE Finance Council Investor Reporting Package Loan Periodic File to conduct the analysis.

The study’s notable observations included:

— There were 1,595 loans (8.3% of the population) totaling $64.4 billion (13.1%) that were transferred to special servicing. Of these, 44.5% (710) by loan count and 52.7% ($34 billion) by balance transferred back to the master servicer. Another 14.6% (233) and 10.5% ($6.7 billion) were paid off or resolved by loan count and balance, respectively.

— Of the loans that were paid off or resolved, about two-thirds (64.8%) totaling $5.2 billion (77.7%) did so without a reported loss.

–KBRA found that 1,082 (5.6%) loans totaling $52 billion (10.6%) were modified. Of these, 55.2% by loan count and 40.6% by balance were modified without the loan being transferred to the special servicer.

— Of the loans that have been transferred back to the master servicer, 53% did not report a modification. “This suggests that many properties managed to stabilize and/or recover without additional relief from the special servicer,” the report said. Concerns about re-defaults after a modification have generally not materialized, KBRA said. The report found 22 loans totaling $1.1 billion that were returned to the special servicer after having been moved to the special servicer and later returned to the master servicer.