BREAKING NEWS

Applications Fall in MBA Weekly Survey; MBA Reports 1Q IMB Production Profits Decrease

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $223 on each loan they originated in the first quarter, a sharp drop from a reported gain of $1,099 per loan in the fourth quarter, the Mortgage Bankers Association reported Tuesday.

Mortgage applications fell for the second straight weeks even though mortgage interest rates also fell over the same period, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 20.

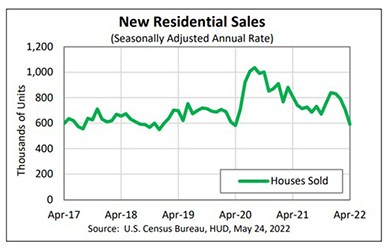

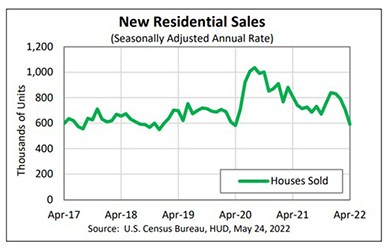

New home sales in April suffered double-digit percentage losses for the second consecutive month, falling to their lowest level since June 2020, HUD and the Census Bureau reported Tuesday.

It’s not exactly a race, but so far in 2022, home values in the suburbs sped ahead of urban growth values, continuing a trend began last summer, said Zillow, Seattle.

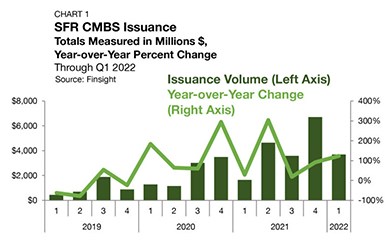

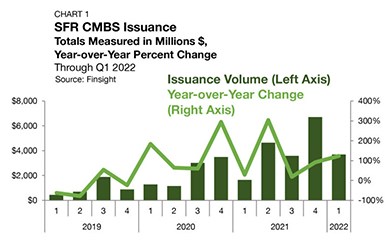

The single-family rental sector gained momentum in the first quarter, even as profit margins declined, analysts reported.

Seth Appleton, president of MISMO®, issued the following statement in support of Ginnie Mae’s recent announcement regarding updates and enhancements to its Digital Collateral Program and eGuide:

Merchants Capital and Merchants Bank of Indiana, Carmel, Ind., completed a $214 million securitization of 14 multifamily mortgage loans secured by 24 mortgaged properties through a Freddie Mac-sponsored Q-Series transaction.

MBA CONVERGENCE presents a timely webinar, Understanding and Serving Today's Buyer, on Thursday, June 23 from 3:00-4:00 p.m. ET.

Tom Lamalfa is a 44-year veteran of mortgage market research, whose focus in recent years has been on federal housing policy. He is president of TSL Consulting, Cleveland Heights, Ohio. His semi-annual reports on the housing and mortgage finance industries appear regularly in MBA NewsLink.

Whether or not you personally believe climate change exists, the White House, federal regulators, states and even other countries are clearly signaling that mortgage companies need to measure climate risks.

The Mortgage Bankers Association and Winnos Solutions LLC, Anaheim, Calif., announced a partnership that will provide MBA member subscribers – at a 10% discount rate – a comprehensive database of state and federal regulations to help control costs and better manage the growing complexity of mortgage regulations.

In another effort to promote enforcement of consumer protection laws, the Consumer Financial Protection Bureau last week issued an interpretive rule that supports states’ authorities to pursue lawbreaking companies and individuals that violate provisions of federal consumer financial protection law.

NAMMBA, the National Association of Minority Mortgage Bankers of America, holds its annual CONNECT 2022 Conference Sept. 15-17 at the JW Marriott Bonnet Creek Resort & Spa.