Cushman & Wakefield: Considerable Scope for Commercial Real Estate to Absorb Rate Increases

Changes in interest rates and changes in commercial real estate cap rates have a weak relationship historically, said Cushman & Wakefield, Chicago.

“Rather, what matters is whether the economy is growing and whether cap rate spreads are wider or narrower relatively to history,” Cushman said in its Capital Markets U.S. Outlook. “The economy will continue to grow and spreads are mostly at around long-term average levels, which means that there is considerable scope for the market to absorb rate increases. Moreover, in the event that the economy were to move into a higher inflation regime, history suggests that commercial real estate returns would more than compensate for this higher inflation in the form of higher total returns.”

The report noted a “capital tsunami” is currently driving the market and affecting real estate debt, equity, volumes, valuations, asset mix and geography. It said the global money supply is nearly 25 percent higher than it was at year-end 2019–a $20 trillion increase. “A portion of that has gone directly into property market while still more is set to come as institutional investors rebalance their portfolios following huge run-ups in the values of their public equity portfolios.”

Cushman said the market is already seeing this as dry powder at closed-end funds has increased 20 percent since December 2019. “Open-ended core fund contributions are now increasing as is funding for public and especially non-traded REITs,” the report said. “Institutional investors are if anything becoming more bullish on real estate as they continue to increase the share of their growing portfolio allocated to the asset class, promising a long tailwind to the sector.”

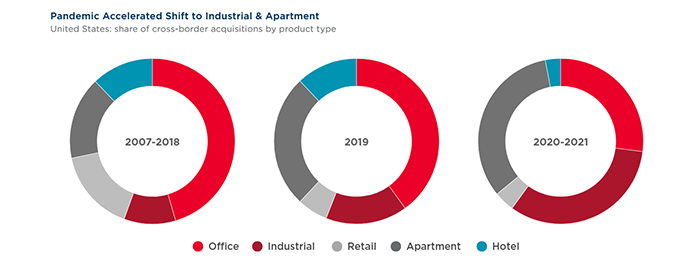

The report noted “extremely strong activity” in the multifamily and industrial product sectors, saying both were up more than 70 percent compared through 3Q 2021 compared to the pre-pandemic average. “Office and retail volumes are nearly recovered,” Cushman said. “Select niche investment sectors have also been winners in the pandemic market, notably R&D/life sciences, affordable housing and senior housing.”

Commercial real estate returns have been well above their historical average in the last year. This drove valuations in many markets and sectors to record levels, Cushman said. “This can be a cause for concern, but it is important to keep in mind that commercial real estate is only one asset class among many for investors; hence, it is important to look at the valuations of commercial real estate relative to these alternative investments, namely global public equity and fixed income,” the report said. “We find that commercial real estate valuations represent a relative value compared to these alternatives, particularly fixed income; moreover, commercial real estate offers higher yield per unit risk compared to other asset classes in addition to being a strong inflation hedge. All of these factors argue in favor of continued capital flows into commercial real estate and sustainability of prevailing pricing.”