BREAKING NEWS

Mortgage Applications Fall Again as Rates Climb in MBA Weekly Survey

Mortgage applications fell again last week to their lowest levels since 2019 as mortgage interest rates pushed to highs not seen in nearly three years, the Mortgage Bankers Association reported Wednesday in its Weekly Applications Survey for the week ending Feb. 25.

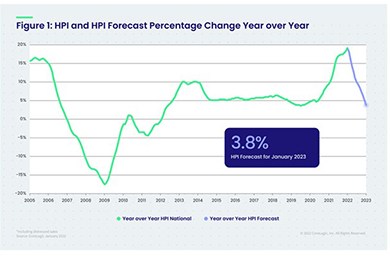

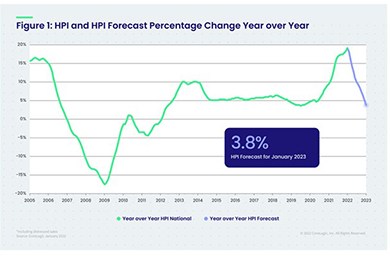

CoreLogic, Irvine, Calif., said annual home price appreciation in January jumped to the highest level in at least 45 years.

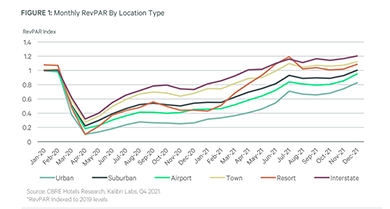

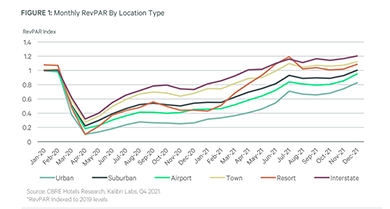

The hotel sector’s recovery that started last year will likely continue despite current operational hurdles, sector analysts reported.

Monthly construction spending started the year strongly, increasing for the sixth consecutive month, the Census Bureau reported Tuesday.

The MBA Path to Diversity Scholarship Program recognizes existing industry professionals who are seeking to advance their careers through continuing education.

The Mortgage Bankers Association is proud to recognize its Premier and Select Associate Members and thank them for their continued support of MBA and the real estate finance industry.

Lument, New York, closed $29.5 million for seniors housing and multifamily properties in Fort Wayne, Ind. and Denver.

Whether verification of income, employment or assets; or payment histories tied to rent rolls and utilities like mobile phone service; by incorporating these additional data sets into the loan decisioning process, lenders gain a deeper understanding of the borrowers they serve.

During this time of the year, one area of compliance stands out as a focal point: HMDA.

Home sales, which increased more than 6% in 2021 to a 15-year high, will remain strong this year — supported by solid demographic trends and an expected increase in homes for sale, according to the winter edition of The Housing and Mortgage Market Review from Arch Mortgage Insurance Co., Greensboro, N.C.

For nearly two decades, creating a completely digital process from application to the secondary market has been one of the mortgage industry’s greatest, most exciting and most difficult challenges. The eMortgage remains an elusive goal—but today we’re closer to it than ever.

A lender committed to DEI focuses on building staff, leadership and a customer base that reflect the borrowers it wants to serve. Diverse staff and leadership create an environment where a broader range of ideas can flourish, boosting a company’s bottom line.

One of the primary lessons of the COVID-19 crisis was that technology is an absolute requirement for business continuity in the mortgage industry and many others. This was a harsh lesson for many as mortgage lenders do not have a solid track record of adopting new technology promptly.