Cross-Border Investment in U.S. Industrial Assets Sets Record

Cross-border investors accounted for a record-setting $19.5 billion in demand in industrial assets in 2021, up more than 150 percent year-over-year, reported JLL, Chicago.

Overall investor demand in U.S. industrial assets reached $143 billion last year, up 32 percent from 2019’s previous high-water mark, JLL said.

“Capital typically follows strong property fundamentals and the strength of underlying property fundamentals has helped investors offset inflation fears, driving a record level of investment activity in 2021,” said JLL Senior Managing Director John Huguenard, Industrial Platform Leader with the firm’s Capital Markets group. “The favorable consumption patterns in the U.S., combined with the pressure to allocate record level dry powder, will continue to drive investors to the industrial sector this year.”

JLL said just five countries account for more than 90 percent of total cross-border transaction volume last year. Boosted by GIC’s $6.8 billion portfolio purchase from EQT Exeter in the fourth quarter, Singapore led with 57 percent of the transactions, followed by Canada with 21 percent, or $4.1 billion. Bahraini, French and South Korean investors also funneled significant capital into the industrial sector.

Canadian investors increased their investment activity in the U.S. by 64.5 percent year-over-year “and they show no signs of slowing down,” JLL said. The activity was led by the $2.2 billion-acquisition of a 14.5 million-square-foot infill and light industrial portfolio by Oxford Properties Group, Toronto. Oxford also formed a joint venture in December with Denver-based EverWest Real Estate Investors to acquire and develop $1 billion (gross asset value) of infill, small-bay industrial properties across the U.S.

“We are surrounded by a surplus of foreign capital in the industrial market that has propelled strong operators to grow their portfolios and platforms,” said Marc Duval, Managing Director with JLL’s Capital Markets group. “We anticipate more partnerships to form in the coming months due to foreign capital’s further interest in U.S. industrial real estate.”

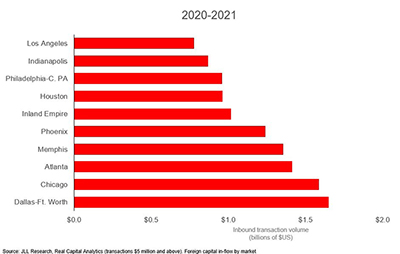

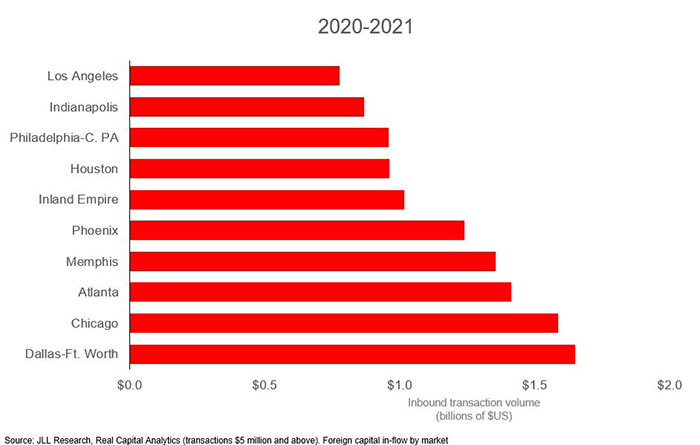

JLL noted another trend seen last year: a shift in the markets benefiting from the most cross-border investment. “Where Dallas, Chicago, Atlanta, Los Angeles and the Inland Empire have consistently been favored markets since 2016, Memphis, Phoenix, Houston, Philadelphia and Indianapolis have become more sought after,” the report said.

Nicholas Rita, Research Manager for Industrial Capital Markets with JLL, said many investors have accelerated their capital placement toward Sun Belt markets, attracted by their strong economies and positive demographic trends. “These favorable market conditions will facilitate further investor interest in 2022,” he said.