Institutional-Quality Real Estate Returns Set Record

Institutional-quality commercial real estate returned 6.15 percent in the fourth quarter, up from 5.23 percent in the third quarter, the National Council of Real Estate Investment Fiduciaries reported.

The quarterly return, which consisted of 1.03 percent from income and 5.12 percent of appreciation, represented the highest appreciation since the NCREIF Property Index began in 1978. Market values before considering capital expenditures also increased at a record 5.40 percent, the report said.

The 6.15 percent return represents the unleveraged returns for mostly “core” real estate held by institutional investors throughout the U.S. NCREIF noted properties with debt financing had an 8.05 percent leveraged total quarterly return.

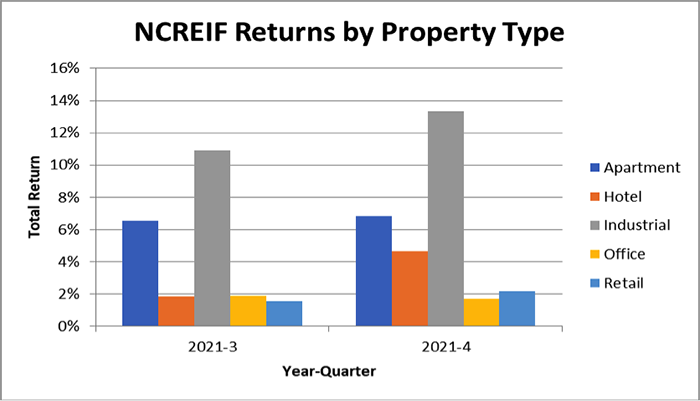

NCREIF noted the industrial sector continues to “propel” the index. “The story continues to be the exceptionally strong performance of the industrial (primarily warehouse) sector,” the report said. The industrial sector returned 13.34 percent for the quarter, up from 10.92 percent the prior quarter. Apartment properties saw the second-highest return at 6.82 percent, up slightly from 6.53 percent in the third quarter.

“Surprisingly, the third-best performance was from hotel properties,” NCREIF said. Hotels returned 4.64 percent in late 2021, up from 1.83 percent in the third quarter. Retail and office returns equaled 2.18 percent and 1.68 percent, respectively.

“The strong performance for the fourth quarter of 2021 was also driven by record returns of non-gateway vs. gateway cities,” the report said. “The so-called gateway cities are generally considered to be Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C. Perhaps due to COVID causing migration to less dense urban areas, the non-gateway cities have increased relative to the gateway cities and reached a record level in the history of the NPI this quarter.” Non-gateway cities saw a 7.36 percent quarterly total return, NCREIF said.

The institutional investors surveyed tend to be long-term investors, with an average of between 100 and 200 sales of properties each quarter. But sales equaled 284 in late 2021 quarter, up from 228 the prior quarter and only 30 during the midst of COVID. “Transactions are usually high when the market is strong and there is a lot of liquidity in the private real estate market,” NCREIF said.