Large Office Markets Show Stability Despite COVID Uncertainty

CBRE, Dallas, reported large U.S. office markets showed stability in November despite continued uncertainty about COVID.

The firm’s Pulse of U.S. Office Demand report found minimal change in activity from the steady recovery seen in recent months.

“It’s rare that a draw can be considered a win, but that is the case with November office-leasing activity in these top 12 markets,” said Nicole LaRusso, CBRE Director of Research & Analysis. “Uncertainty typically hampers leasing activity. But with two of our indices showing only tiny losses and the third holding steady, it appears that companies remain focused on their long-term needs for office space.”

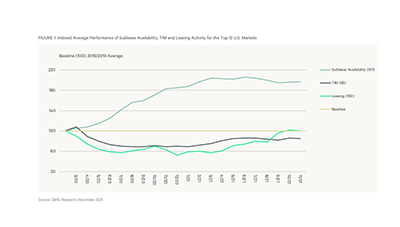

To gauge the recovery, CBRE tracks three office market indicators in the 12 largest U.S. markets: tenants in the market, leasing activity and sublease space availability.

Overall, Boston led in recovery among the 12 markets, with tenants in the market activity 23 percent higher than pre-crisis levels and leasing activity more than double that benchmark. Dallas-Fort Worth generated strong gains in November to take the runner-up position. Other leaders for overall activity included Los Angeles, Manhattan and Washington, D.C.

The Tenants in the Market index held steady at 85 in November, on par with its peak from June and July. Half of the 12 markets now have TIM-index readings exceeding 90. Boosted for the past two years by demand for life-sciences space, Boston remained well ahead of the pack at 123 despite a TIM index drop in November. TIM-index gainers included Dallas-Fort Worth (101 reading in November), Manhattan (99) and Houston (94).

The Leasing Activity Index fell two points in November to 100, CBRE reported. Boston registered a 38-point gain in its index to 209. Three markets, Washington, D.C. (122), Los Angeles (109) and Manhattan (102) crossed the 100-point baseline in November. Overall, six markets notched gains in their leasing activity indices in November, including Los Angeles’ 21-point increase.

The Sublease Availability Index illustrates the market’s largest remaining challenge, CBRE noted. This index increased by one point in November to 197, meaning the sublease overhang remains nearly double its pre-crisis level.

Four markets registered sublease index declines in November: San Francisco, Manhattan, Denver and Boston. Of the other eight markets, Houston and Washington registered flat sublease readings in November.