CBRE: CRE Lending Soars as Markets Enter Expansion Phase

Chart courtesy of CBRE

CBRE, Dallas, reported commercial real estate lending activity surged in the third quarter, reflecting rebounding property acquisitions activity.

The CBRE Lending Momentum Index, which tracks U.S. commercial loan closings, soared in the quarter to 376–up 31.6 percent from June and 29.1 percent from just before the pandemic. The index is now up by 135 percent compared with its low point a year ago when lending activity fell sharply amid COVID-19.

“The number of new lenders entering the market or existing lenders expanding their programs is extraordinary,” said Brian Stoffers, CMB, Global President of Debt & Structured Finance for Capital Markets at CBRE (and past Chair of the Mortgage Bankers Association). “Capital chasing equity-like returns has found it more difficult to invest, and many have pivoted to high-yield debt strategies, such as real estate, that provide attractive risk-adjusted returns.”

Stoffers noted lending on value-added assets remains strong, “supporting debt funds and other alternative lenders’ leading share of non-agency commercial mortgage origination activity.”

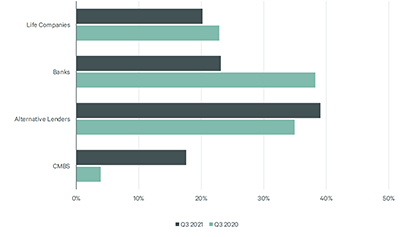

The survey found activity by alternative lenders such as debt funds and mortgage real estate investment trusts led volume in the quarter, accounting for 39 percent of all non-agency loan closings. It called their share consistent with Q2 2021 as borrowers continue to seek financing for value-added assets.

Year-to-date, bridge loans accounted for nearly 80 percent of alternative lender loan closings, while construction loans accounted for 13 percent. “Debt funds have tapped a strong collateralized loan origination market to term-finance their loan portfolios,” the report said.

Banks were the second most active lending group in the quarter, accounting for 23.1 percent of loan closings. Banks were active in bridge lending, making up almost half of their quarterly activity. Permanent loans accounted for an additional one-third and construction loans accounted for 19 percent of bank loan volume. Multifamily, office and industrial assets made most up bank loan closings in the quarter.

“Life companies have maintained a relatively consistent share of loan closings over the past several quarters,” the report said, noting LifeCos accounted for just over 20 percent of closings, primarily fixed-rate permanent loans on multifamily, office and retail assets.

Commercial mortgage-backed securities loan origination activity gained pace during the quarter, lifting the sector’s share to its highest level since early 2020, CBRE reported. CMBS accounted for 17.6 percent of loan closings, up from 3.9 percent a year ago. “Industry-wide CMBS origination volume has been on the upswing, with several additional deals slated to close by year-end,” the report said.

CBRE said underwriting criteria were slightly more aggressive in the third quarter than in the previous quarter. Underwritten cap rates and debt yields were lower, while the percentage of loans carrying full or partial interest-only terms jumped above 61 percent from 54.2 percent in Q2 2021. Full-term interest-only accounted for 23.3 percent of loans in Q3 2021, up from 19.8 percent in Q2 2021.

Multifamily agency loan production increased to $34 billion in the quarter from $24 billion in the second. Year-to-date volume totals $93.5 billion, just $3.9 billion less than in the same period a year ago. CBRE’s Agency Pricing Index, which reflects the average agency fixed mortgage rates for closed permanent loans with a seven- to 10-year term, decreased by 15 basis points in Q3 2021 to average 3.13 percent. Rates are up 27 basis points from a year ago.