Fannie Mae: Consumers More Optimistic About Homebuying Conditions for First Time in 6 Months

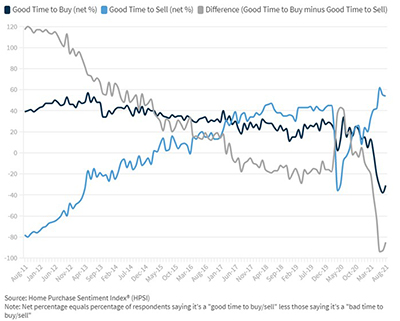

(Chart courtesy Fannie Mae.)

The Fannie Mae Home Purchase Sentiment Index was largely unchanged in August, decreasing 0.1 points to 75.7, as survey respondents tempered both their recent pessimism about homebuying conditions and their upward expectations of home price growth.

However, the Index showed overall, three of the index’s six components increased month over month. Most notably, a greater share of consumers believes it’s a good time to buy a home – though that population remains firmly in the minority at only 32 percent – while the ongoing plurality of respondents who expect home prices to go up over the next 12 months declined to 40 percent, down from last month’s 46 percent but still well above the 24 percent of consumers who believe home prices will decline. Year over year, the full index is down 1.8 points.

“The continued strength of demand for housing and favorable home-selling conditions may be offsetting broader concerns about the Delta variant and inflation that have negatively impacted other consumer confidence indices,” said Mark Palim, Fannie Mae Vice President and Deputy Chief Economist. “Most consumers continue to report that it’s a good time to sell a home – but a bad time to buy – and they most frequently cite high home prices and a lack of supply as their primary rationale. However, the ‘good time to buy’ component, while still near a survey low, did tick up for the first time since March, perhaps owing in part to the favorable mortgage rate environment and growing expectations that home price growth will begin to moderate over the next 12 months.”

The HPSI is down 1.8 points compared to the same time last year. Other key findings:

–Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home increased from 28% to 32%, while the percentage who say it is a bad time to buy decreased from 66% to 63%.

–Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home decreased from 75% to 73%, while the percentage who say it’s a bad time to sell decreased from 20% to 19%.

–Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months decreased from 46% to 40%, while the percentage who say home prices will go down increased from 21% to 24%. The share who think home prices will stay the same increased from 27% to 31%.

–Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 5% to 6%, while the percentage who expect mortgage rates to go up decreased from 57% to 53%. The share who think mortgage rates will stay the same increased from 31% to 35%.

–Job Concerns: The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 84% to 82%, while the percentage who say they are concerned increased from 13% to 15%.

–Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 27% to 26%, while the percentage who say their household income is significantly lower decreased from 14% to 12%. The percentage who say their household income is about the same increased from 56% to 59%.