TransUnion: Healthy Consumer Credit Market Drives Return to Lending

(Chart courtesy TransUnion, Chicago.)

TransUnion, Chicago, said the financial services industry is rebounding strongly from the early impacts of the COVID-19 pandemic, with auto, credit card, mortgage and personal loan industries exhibited renewed signs of strength at the mid-point of 2021.

The company’s Q2 2021 Quarterly Credit Industry Insights Report said financial institutions are returning to lending and extending credit due to the greatly improved view of consumer credit health since the start of the COVID-19 pandemic. It noted in the initial months of the pandemic, many lenders struggled with making credit available to consumers in the face of branch closures and a remote workforce. One year later, lenders have adapted and shifted to a digital-first origination strategy and enhanced their capabilities to originate new accounts virtually.

The report said signs of this origination growth were observed in the second quarter, with originations increasing 76% year over year in the mortgage industry and 16% in the auto industry. Personal loan and credit card industries are expected to show year over year origination growth in the coming quarter.

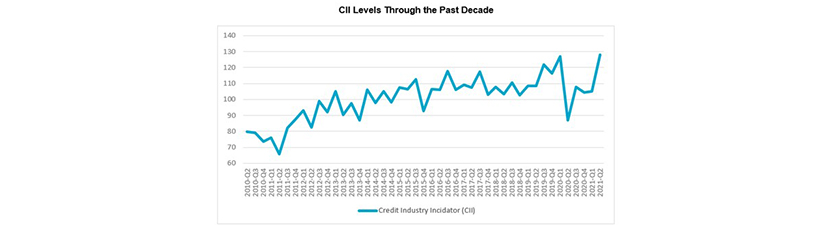

“The latest Credit Industry Indicator indicates that we are well on the road to recovery, and we expect CII levels to continue to grow over the course of the year, so long as COVID cases drop, reopening plans continue, and consumer spending levels remain robust,” said Matt Komos, vice president of research and consulting.”

New Home Purchases, Refinancing Drive Mortgage Industry Growth

The report said mortgage origination volumes remain strong and showed a significant 78% year over year. Among origination loan types, government-sponsored enterprise loans doubled (110%) year over year, while Jumbo and FHA loan types grew at a much slower pace – 28% and 22% year over year, respectively. TransUnion noted while refinances have declined from record levels, they accounted for the bulk of origination volume in the first quarter with 60% of total originations. Rising home prices have pushed the average balance of new mortgage loans to a record $298,115 in the second quarter, driving total balances to $10.3 trillion, another record. Account performance, however, remains steady as mortgage account delinquencies declined to 0.60% 90+ days past due in the second quarter and are 29% lower than the same period last year (0.84% 90+DPD).

“The low interest rate environment has continued to spur an influx of mortgage origination activity across the board,” said Joe Mellman, senior vice president and mortgage business leader with TransUnion. “Compared to last year, however, refinancing is once again outpacing purchase volume as consumers take advantage of historically low rates for Rate and Term and Cash-Out refinancing. While new home purchase activity is still robust, rising home prices are potentially pricing some borrowers out of the housing market. These rising home values have driven mortgage balances to record highs. We expect origination volumes to remain healthy.”

Consumer Performance Remains Strong in Consumer Lending Industry

The report said the unsecured consumer lending industry continues to show signs of recovery. In the second quarter, balances increased quarter over quarter for the first time since the pandemic began (by 1.7%), while consumer-level delinquencies fell – improving to 2.28% 60+DPD (26% lower than Q2 2020). Delinquency rates remain well below historical trends and stand at their lowest level since 2015.

TransUnion said average new account balances grew 7.5% year over year – driven by growth across all risk tiers. These positive trends signify health in the personal loan market, with many lenders looking to ramp up originations to meet renewed consumer demand after the industry saw a drop in the number of consumers with a personal loan since the start of the pandemic.

“The market is showing signs of recovery with lenders taking a measured return to their lending approach,” said Liz Pagel, senior vice president and consumer lending business leader with TransUnion. “While Q1 originations are still trailing Q1 2020 levels, lenders are gradually extending more credit, with the difference from pre-COVID narrowing each quarter. Increased spending is expected to continue and to ramp up throughout the year as more consumers look to access credit. Given this trajectory, originations should begin to show growth, especially as loan performance remains strong.”

Lender, Consumer Confidence Drive Rebound in Credit Card Industry

The report said consumers with access to credit cards reached another all-time high at 192 million in Q2 2021, a 2.8% increase from the same period last year. Originations continue to rebound. After experiencing year over year declines of -17.7% in Q4 2020 and -34.1% in Q3 2020, the gap narrowed to a decline of -3.3% in Q1 2021. In another sign that the supply and demand for credit is normalizing, significant growth was observed from the subprime risk tier, which jumped 22.7% year over year. Total balances decreased 4.1% year over year while the super prime risk tier grew 8.9% year over year showing a leading indicator that super prime consumer confidence is driving an increase in spending and the associated balance growth. Consumer performance remains strong with serious delinquency rates at a historical low, falling to 0.95% of borrowers 90+DPD in the second quarter.

“Confidence in the economy is growing as consumer spending continues to ramp up and key credit card metrics move at or above 2019 pre-pandemic levels as a sign of recovery,” said Paul Siegfried, senior vice president and credit card business leader at TransUnion. “To meet consumer demand, issuer supply has broadly returned to market, with uncertainty being managed through lower credit line assignments. While consumer credit card defaults are at historical lows, card issuers continue to be prudent with the risk mix of consumers with access to credit and have followed a trend of shifting credit line growth toward lower risk consumers.”