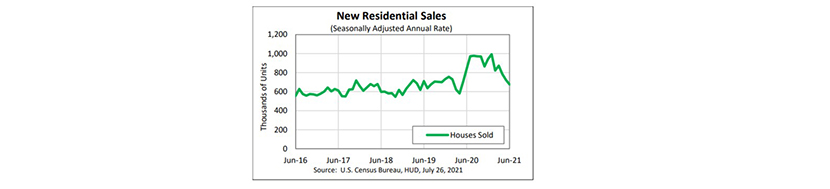

June New Home Sales Down 6.6%

June new home sales fell well below consensus expectations, HUD and the Census Bureau reported Monday, though analysts did not appear to be too worried by the results.

The report said sales of new single‐family houses in June fell to a seasonally adjusted annual rate of 676,000, 6.6 percent below the revised May rate of 724,000 and 19.4 percent lower than a yar ago (839,000).

Regionally, results were mixed. Sales in the Midwest rose by nearly 28 percent in June to 92,000 units, seasonally annually adjusted, from 87,000 units in May and improved by 7 percent from a year ago.

In the South, sales fell by nearly 8 percent to 367,000 units in June, seasonally annually adjusted, from 398,000 units in May and fell by nearly 25 percent from a year ago. In the West, sales fell by 5.1 percent to 186,000 units in June from 196,000 in May and fell by nearly 13 percent from a year ago. In the Northeast, sales fell by nearly 28 percent in June to 31,000 units from 43,000 unit in May and fell by more than 40 percent from a year ago.

Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C., noted sales were well below even the 800,000-unit annual rate pre-report consensus, with previous sales numbers revised down by a cumulative 90,000 units during the prior three months.

“Since peaking at a 993,000-unit annual rate in January, new home sales have lost considerable momentum,” Vitner said. “The drop in sales reflects sticker shock on the part of buyers, some shifting in buyers’ attention toward services spending and a high degree of restraint on the part of home builders. The latter is the most important. Many home builders are limiting sales in new communities due to ongoing supply shortages of building materials, HVAC equipment and appliances. The impact of these sales caps are exacerbated by the seasonal adjustment process. Supply chain woes are not only the underlying thread behind the home sales shortfall but are also likely chipping away a few percentage points from economic growth elsewhere.”

However, Vitner noted while there have already been a number of calls projecting that housing has peaked for the cycle, “we do not see the recent pullback in sales as all that dire. There are at least three issues currently restraining new home sales. Home prices skyrocketed late last year, triggering some hesitancy on the part of buyers. The hesitancy came at a time when there [was] a growing list of distractions, as many consumers have increased spending on travel and leisure. Finally, home builders have been limiting sales at new home communities because they are having a tough time securing the materials, workers and appliances needed to build a new home. The important point is that home builders are still selling virtually everything they build. Inventories of completed homes, while they have increased slightly, remain near an all-time low.”

Vitner said demand for new homes remains strong at the upper end. And he added that home builders are still selling nearly everything they build. “We expect supply chain woes to gradually subside during the second half of 2021 and look for sales and new home construction to rebound modestly from their current levels,” he said. “We also are looking for new home prices to moderate, as lower lumber prices allow builders to boost construction of more modestly priced homes, primarily in the South and Southwest.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said while June sales were considerably lower than forecast, following the earlier reported June decline in housing starts, the drop-off in sales was not surprising.

“Some of the slowing in the sales pace likely reflects a move toward normalization in homebuying demand following the pandemic-related surge,” Duncan said. “A recent measure of homebuilders’ sentiment revealed a pullback in the buyer foot traffic metric, which reached the lowest level in nearly a year, while the June 2021 Fannie Mae Home Purchase Sentiment Index showed a further increase in the share of respondents indicating it’s a bad time to buy a home. We believe many of the past year’s buyers likely pulled forward their intended purchases to take advantage of low mortgage rates and remote working opportunities, while stimulus checks provided down payment support.”

The report said the median sales price of new houses sold in June was $361,800; the average sales price was $428,700. The seasonally adjusted estimate of new houses for sale at the end of June rose to 353,000, representing a supply of 6.3 months at the current sales rate.