CRE Lending Showing Resilience

The improving economy created a favorable capital markets environment for commercial real estate lending in early 2021 despite continuing challenges in office and retail loan underwriting, said CBRE, Dallas.

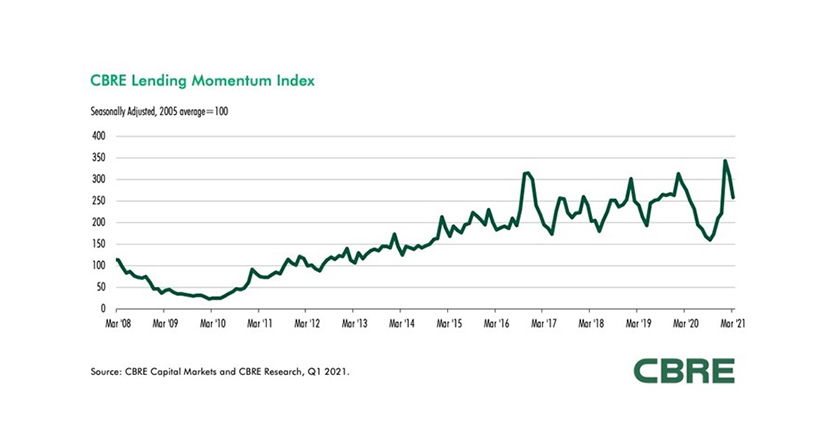

The CBRE Lending Momentum Index report, which tracks the pace of commercial loan closings, continued its recovery trend in the first quarter, finishing March at a value of 258, up 16.7 percent from December 2020.

Lending activity hit its most recent low in September 2020, when the index value equaled 160, CBRE reported. The index reached a cycle high 342 in January and is now just 6 percent below its year-ago level.

Brian Stoffers, CMB, Global President of Debt & Structured Finance for Capital Markets at CBRE (and past Chair of the Mortgage Bankers Association), said banks and alternative lenders such as credit companies and debt and pension funds were most active in the first quarter. He noted credit spreads and mortgage rates remained “quite favorable” to borrowers.

“Many regional banks provided capital across a variety of product types, including permanent, bridge and construction loans,” Stoffers said. “Alternative lenders continue to be a strong source of bridge capital for transitional assets.”

The survey found after trailing life companies and alternative lenders in late 2020, banks took the top spot in the first quarter with 39.2 percent of non-agency commercial mortgage originations. Construction loans, mostly for warehouse and multifamily projects, accounted for 35 percent of bank originations, which Stoffers called a promising sign for a return to normal lending market conditions.

Alternative lenders accounted for just over 30 percent of originations, primarily providing bridge loans across multiple property types, particularly multifamily, the report said. Life companies accounted for 19.2 percent of commercial mortgage originations in early 2021, primarily permanent loans with an average loan-to-value ratio of 54 percent.

Commercial mortgage-backed securities lenders made 11 percent of originations in the first quarter. CMBS issuance totaled $15.2 billion, down from $22.9 billion in first-quarter 2020. “While the CMBS market is off to a modest start in 2021, higher origination volume is expected in the second half of the year as pandemic restrictions ease and acquisition and refinance activity increases,” CBRE said.

Though underwriting criteria eased and loan proceeds increased, the percentage of full-term interest-only loans fell from 66.7 percent in late 2020 to 60.6 percent in early 2021. The report said the amortization rate, which measures the average percentage of original loan balance that pays down over the loan term, increased to 26.8 percent in the first quarter from 18.6 percent in fourth-quarter 2020.