MBA Advocacy Update May 3, 2021

On Wednesday, the Biden administration unveiled the American Families Plan, an ambitious $1.8 trillion proposal that would make $1 trillion in new investments and provide $800 billion in tax cuts over 10 years, paid for with tax increases on upper-income taxpayers, new tax enforcement initiatives, and changes to the way capital is taxed. On Tuesday, the CFPB released a final rule delaying the mandatory compliance date of the General QM final rule until October 1, 2022. Meanwhile, FHFA announced preliminary details that Fannie Mae and Freddie Mac soon will offer a new refinance option for low-income borrowers.

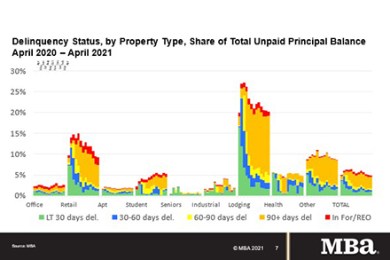

MBA: April Commercial/Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in April, reaching the lowest level since the onset of the COVID-19 pandemic, the Mortgage Bankers Association's latest monthly CREF Loan Performance Survey reported.

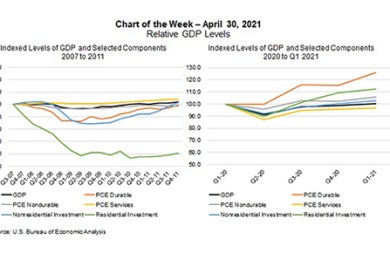

MBA Chart of the Week: Relative GDP Levels

The pace of economic growth, as measured by gross domestic product in the first quarter, picked up to a 6.4 percent annualized rate – the biggest first-quarter increase since 1984. We expect that pace to accelerate further over the next 6 months, as households unleash the pent-up demand for a range of goods and services.

Zillow: Housing Gains Could Grow Black Wealth More Than $500B in a Decade

Zillow, Seattle, said incremental increases in homeownership rates and home values among Black households would help shrink the current $3 trillion racial wealth gap by hundreds of billions of dollars over the next decade.

Industry Briefs May 3, 2021

The Consumer Financial Protection Bureau took action against Nationwide Equities Corp. for sending deceptive loan advertisements to hundreds of thousands of older borrowers.