March Jobs Report: Full Steam Ahead

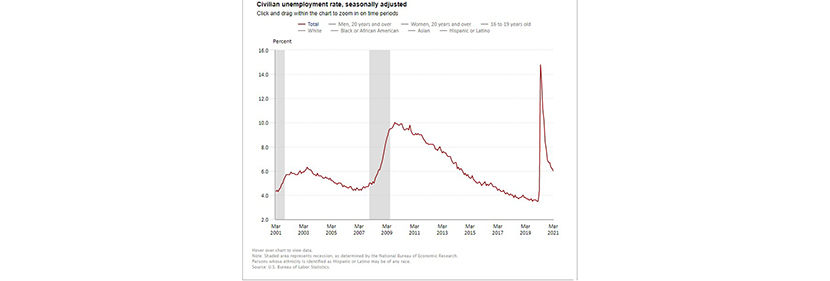

Another sign that the U.S. economy is heating up: the Bureau of Labor Statistics on Friday reported total nonfarm payroll employment rose by 916,000 in March, while the unemployment rate fell to 6 percent.

Labor said the strong numbers in the labor market reflect “the continued resumption of economic activity that had been curtailed due to the coronavirus pandemic.” Job growth was widespread in March, led by gains in leisure and hospitality, public and private education and construction.

But while the unemployment rate is down considerably from its recent high in April 2020 (14.8 percent) but is 2.5 percentage points higher than its pre-pandemic level in February 2020. The number of unemployed persons, at 9.7 million, continued to trend down in March but remains four million higher than in February 2020.

BLS revised total nonfarm payroll employment for January by 67,000, from +166,000 to +233,000, February by 89,000, from +379,000 to +468,000. With these revisions, employment in January and February combined was 156,000 higher than previously reported.

The labor force participation rate changed little at 61.5 percent in March. This measure is 1.8 percentage points lower than in February 2020. The employment-population ratio, at 57.8 percent, was up by 0.2 percentage point over the month but is 3.3 percentage points lower than in February 2020.

“Job growth accelerated sharply in March, with gains across a number of sectors, including both goods-producing and service-providing industries,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “We fully expect that this pace of job gains will continue for months, and anticipate that the unemployment rate, now at 6 percent, will be well below 5 percent by the end of the year.”

Fratantoni noted more than 4.2 million people are still actively looking for work for more than 6 months, and total employment remains 5.5 percent below the February 2020 peak. “Although the job market is certainly recovering quickly, the stimulus payments and renter and homeowner relief that were part of the American Rescue Plan will provide support for struggling individuals who are unemployed or underemployed, including the 2.5 million homeowners currently in forbearance plans,” he said.

“From a housing market perspective, Fratantoni welcomed the 110,000 gain in construction jobs. “There is a desperate lack of inventory in the housing market right now, which is driving up home prices at an unsustainably rapid pace,” he said. “Total construction employment remains 182,000 below its February 2020 level. With the job growth and bright outlook for the remainder of the year, housing demand will remain quite strong, even if mortgage rates increase above 3.5 percent, as we expect.”

“While there is still a lot of ground to make up, the labor market is on track for a relatively quick recovery,” said Sara House, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “The economy took a big step closer to a full recovery with today’s jobs report.”

House said the broader re-opening of the economy, growing optimism that the end of the pandemic is in sight and a reversal of last month’s unseasonably cold weather generated broad gains in hiring. She noted in another sign school and work is moving back toward “normal”, the share of employees teleworking specifically because of the pandemic fell to 21.0%, the lowest rate yet.

“Overall, the aggressive policy support and speed of this cycle should limit labor market scarring,” House said. “The number of permanent job losers remains about half the levels of Great Recession, with workers on temporary layoff still accounting for a relatively high share of job losers at 20.8%. There remains a significant jobs deficit at 8.4 million, but it is being chipped away at quickly. With spending about to boom, its closure is looking closer and closer.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said the March jobs report is “great news for a housing market in an inventory crisis. Residential construction jobs increased 3.9% from the pre-2020 recession peak in Feb. 2020. The construction industry remains a labor-intensive industry. We need more hammers at work to build more homes. March jobs report indicates the highest number of residential construction workers since 2008. Increasing the number of workers is critically important to alleviating the labor shortage challenge. It’s very hard to increase housing starts without increasing construction employment.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said despite robust recent job gains, the level of payroll employment is still about 5.5 percent below pre-pandemic levels. “Participation has been slow to rebound from the depths of the downturn last year, as many people who had left the workforce are yet to return,” he said.

The report said average hourly earnings for all employees on private nonfarm payrolls in March fell by 4 cents to $29.96. Average hourly earnings for private-sector production and nonsupervisory employees, at $25.21, changed little (+2 cents).

The average workweek for all employees on private nonfarm payrolls increased by 0.3 hour to 34.9 hours in March, following a decline of 0.4 hour in the prior month. In manufacturing, the workweek increased by 0.2 hour to 40.5 hours over the month, and overtime increased by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls rose by 0.3 hour to 34.3 hours.