MBA Urges No Delay to CFPB QM Final Rule

The Mortgage Bankers Association, in a letter yesterday to the Consumer Financial Protection Bureau, urged the Bureau not to delay the effective date of its new General Qualified Mortgage Rule, saying the Bureau’s rationale for delaying the rule would not accomplish its stated goals nor benefit consumers.

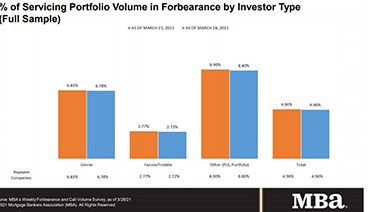

MBA: Share of Loans in Forbearance Hits Pre-Pandemic Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 4.90% of servicers’ portfolio volume as of March 28 from 4.90% the prior week–the fifth consecutive weekly drop and the lowest level in more than a year. MBA estimates 2.5 million homeowners remain in forbearance plans.

SCOTUS Ruling Supports MBA Interpretation of TCPA ‘Autodialer’ Definition

The U.S. Supreme Court unanimously ruled Thursday that a statutory definition of what constitutes an “autodialer” was overly broad, giving Facebook and a number of businesses, including the Mortgage Bankers Association, a decisive legal victory.

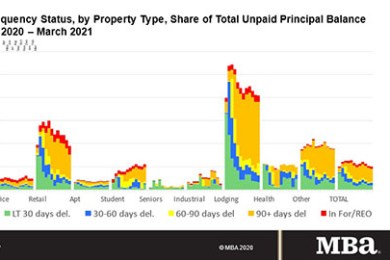

MBA: March Commercial/Multifamily Mortgage Delinquencies Fall for 3rd Straight Month

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in March, reaching the lowest level since the onset of the COVID-19 pandemic, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

CFPB Proposes Mortgage Servicing Changes

The Consumer Financial Protection Bureau yesterday proposed a set of rule changes it said are intended to help prevent “avoidable foreclosures” as emergency federal foreclosure protections expire.

Fitch: Risks to Affordable Multifamily Housing Remain Despite Stimulus

Fitch Ratings, New York, said rental assistance provided under the American Rescue Plan will help renters and multifamily property landlords, but the extent to which the ARP can keep delinquencies low is uncertain, as the amount of unpaid back rent is difficult to estimate due to lack of data.