LBA Ware: 4Q Loan Compensation Jumps by More than 100%

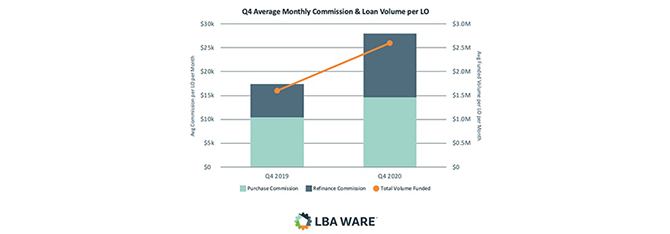

(Chart courtesy LBA Ware.)

LBA Ware, Macon, Ga., said strong volume and additional headcount resulted in total loan compensation paid out in the fourth quarter jumped by more than 100% from a year ago.

The company’s Q4 2020 Loan Compensation Report, which analyzes its CompenSafe ICM platform, shows robust refinance and purchase loan volume in Q4 contributed to markedly higher earnings for both LOs and loan processors in 2020 from a year ago. Total loan volume funded increased 106% in Q4 2020 compared to Q4 2019.

Other report findings:

● LO headcount increased 27% year-over-year.

● Average individual production in Q4 2020 grew $2.6 million per month, an increase of 63% from $1.6 million in Q4 2019.

● Per-loan LO commissions held relatively steady, decreasing 0.2% from 105.4 basis points in Q4 2019 to 105.2 bps in Q4 2020.

● Purchase volume grew 71% year-over-year with LOs averaging $1.35 million in funded purchase loans per month in Q4 2020 (a 38% increase from $0.98 million in Q4 2019) and receiving on average 111.1 bps per purchase loan (up from 109.1 bps in Q4 2019).

● Refinance volume grew 158%, accounting for 51% of total volume funded in Q4 2020 (versus only 41% of total volume funded in Q4 2019). LO commissions on refinance loans remained steady at 99.3 bps in Q4 2020 compared to 99.2 bps in Q4 2019.

● Processor headcount increased 51% year-over-year, allowing this group to handle 99% more loan files in Q4 2020 compared to Q4 2019.

● Per-loan bonus compensation earned by processors increased 21% to $128 per loan in Q4 2020 ($106 in 2019), earning processors an average production bonus of $2,503 per month ($1,569 in 2019).

Additionally, the report said on average, LOs funded $20.4 million in annual volume in 2020, with transactions split evenly at 50% purchase loans and 50% refinance loans. Per-loan commissions earned by LOs in 2020 averaged 105.5 bps, with refinance loans averaging 100.2 bps and purchase loans averaging 110.6 bps.

“Low interest rates flamed an increased demand for mortgage activity, which in turn benefited LOs and processors. They were rewarded for their long hours with robust compensation checks,” said LBA Ware Founder and CEO Lori Brewer. “As rates are predicted to rise in 2021 and for several years to come, loan teams that wish to maintain their earnings would do well to put a strategy in place that enables them to offset waning refi volume with more purchase volume.”