Initial Claims Continue to Backslide

Initial claims for unemployment benefits jumped for the second consecutive week, raising concerns about the sustainability of the current economy and raising alarms with unemployment benefits set to expire.

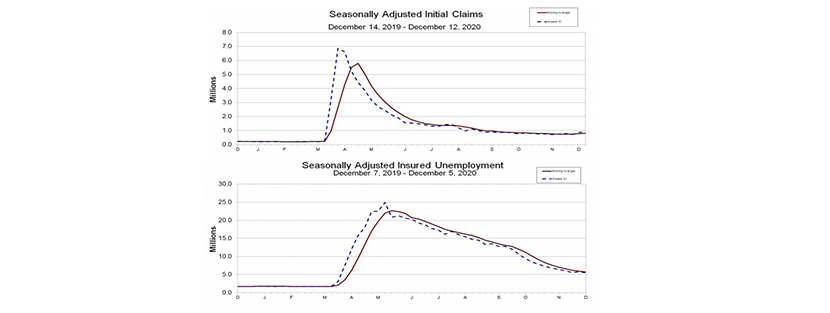

For the week ending Dec.12, the advance figure for seasonally adjusted initial claims rose to 885,000, an increase of 23,000 from the previous week’s revised level. The previous week’s level was revised up by 9,000 from 853,000 to 862,000. The four-week moving average was 812,500, an increase of 34,250 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate—also known as continuing claims—fell to 3.8 percent for the week ending December 5, a decrease of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending December 5 fell to 5,508,000, a decrease of 273,000 from the previous week’s revised level. The previous week’s level was revised up 24,000 from 5,757,000 to 5,781,000. The four-week moving average fell to 5,726,250, a decrease of 215,500 from the previous week’s revised average.

“An unexpected rise in initial jobless claims is another sign that the labor market’s recovery is backsliding,” said Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “Claims jumped for a second straight week to 885,000, and raise the risk of a negative print for December payrolls.”

House said renewed restrictions and individual efforts to stem the spread of COVID are bearing down on the labor market. “While Congress continues to debate another round of relief, we are now 39 weeks into the pandemic, the max duration of benefits under the PUA and PEUC (when combined with regular state) programs,” she said. “In total, 20.6 million individuals are receiving unemployment benefits while the jobs market weakens anew.”