Single-Family Rental Market Stabilizes

CoreLogic, Irvine, Calif., said single-family rent growth increased in October, outpacing their previous-year growth rate for the first time since the pandemic started.

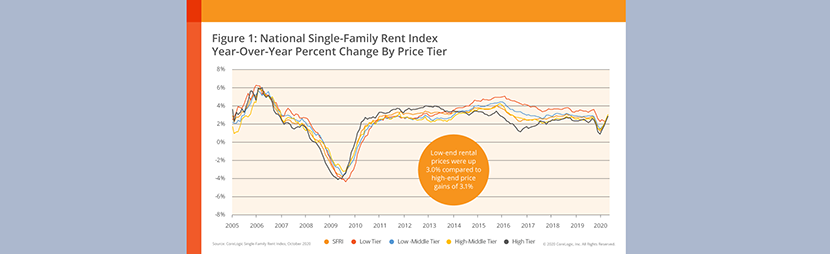

The firm’s Single-Family Rent Index showed a 3.1 percent national rent increase year-over-year, up from a 2.9 percent rate a year ago.

“Demand has grown for higher-tier single-family rentals as more people opt to rent larger spaces in less densely populated areas,” said CoreLogic Principal Economist Molly Boesel. “Rent growth of lower-tier rentals still lags behind pre-pandemic rates, which is to be expected in an economy particularly challenging for low-wage earners.”

Despite a slowing rental prices during the spring and summer, growing work-from-home needs and a desire for outdoor space increased demand for single-family homes, ensuring a pickup in the pace of single-family rent growth, CoreLogic said. “Similar to the low inventory of homes for purchase, the supply of single-family rentals also declined during the pandemic,” the report said. Over the summer, the supply of single-family rentals fell by 9 percent.

CoreLogic studied four tiers of rental prices:

–Lower-priced SFR assets (75 percent or less than the regional median) saw a 3 percent increase, down from 3.6 percent in October 2019, but up from 2.4 percent in September 2020.

–Lower-middle priced properties (75 percent to 100 percent of the regional median) also saw a 3 percent increase, unchanged from October 2019.

–Higher-middle priced SFR property (100 percent to 125 percent of the regional median) rents increased 3.2 percent, up from 2.6 percent in October 2019.

–Higher-priced assets (125 percent or more than the regional median) saw a 3.1 percent increase, up from 2.7 percent a year ago.

Among the 20 largest metros and for the past 23 consecutive months, Phoenix had the highest year-over-year increase in single-family rents in October at 8.9 percent. Tucson, Ariz., had the second-highest rent price growth in October with a 7.6 percent gain, followed by Charlotte, N.C., at 5.2 percent.

In Las Vegas–which was hit hard by the sudden drop in tourism–the local market has maintained higher-than-average rent growth due to renters moving to more affordable markets from more expensive and densely populated areas such as Los Angeles. Conversely, Boston posted an annual decline in SFR rent prices of 4.1 percent. CoreLogic attributed the drop to a trend toward consolidating households, with many renters opting to live with family or friends as they navigate through the pandemic.

“While the rental market continues towards stabilization, unemployment rates remain elevated across the country, with some regions and metros experiencing higher rates of job loss than others, creating downward pressure on rent prices,” the report said. For example, Honolulu posted a 15.4 percent year-over-year employment decrease, which contributed to a 0.4 percent decline in single-family rent prices. Hawaii began lifting travel restrictions in mid-October, but tourism has yet to rebound.

“As the economy slowly recovers from the impact of the pandemic and contends with the resurgence of coronavirus cases, we may see continued fluctuation of rent prices in metros across the nation,” CoreLogic said.