Initial Jobless Claims Remain Stubbornly High

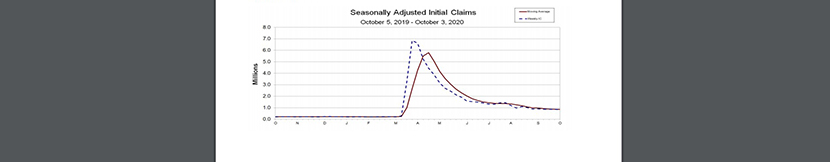

Initial claims for unemployment insurance fell slightly last week, the Labor Department reported yesterday, but only after an upward revision from the previous week’s numbers.

For the week ending Oct. 3, the report said the advance figure for seasonally adjusted initial claims fell to 840,000, a decrease of 9,000 from the previous week’s revised level. However, the previous week’s level was revised up by 12,000, from 837,000 to 849,000.

The four-week moving average fell to 857,000, a decrease of 13,250 from the previous week’s revised average. The previous week’s average was revised up by 3,000 from 867,250 to 870,250.

The report said the advance seasonally adjusted insured unemployment rate fell to 7.5 percent for the week ending September 26, a decrease of 0.7 percentage point from the previous week’s revised rate. The previous week’s rate was revised up by 0.1 from 8.1 to 8.2 percent.

The advance number for seasonally adjusted insured unemployment during the week ending September 26—also known as continuing claims—fell to 10,976,000, a decrease of 1,003,000 from the previous week’s revised level. The previous week’s level was revised up 212,000 from 11,767,000 to 11,979,000. The four-week moving average dipped to 12,112,250, a decrease of 642,000 from the previous week’s revised average. The previous week’s average was revised up by 53,000 from 12,701,250 to 12,754,250.

Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the volume of new claims was more than expected. “After the prior week was revised higher, this is technically a slowing in claims though clearly the labor market is under pressure,” he said.

Quinlan noted although initial claims are well down from the million-plus level of claims in April, Americans have filed more than 800,000 claims per week for more than six months. “To put this in perspective, recall that even at the height of the 2007-09 financial crisis, jobless claims peaked at just 665K,” he said. He also pointed out a key driver once again was Pandemic Unemployment Assistance, which accounted for 464,000 claims – more than half the total figure.