BREAKING NEWS

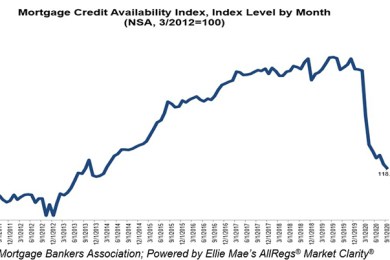

MBA Mortgage Credit Availability Remains at 6-Year Low

Mortgage credit availability decreased in September, remaining at a six-year low, the Mortgage Bankers Association reported this morning.

![]()

In another victory for Mortgage Bankers Association advocacy, the Consumer Financial Protection Bureau yesterday rescinded a controversial Compliance Bulletin on prohibition of kickbacks and referral fees under the Real Estate Settlement Procedures Act.

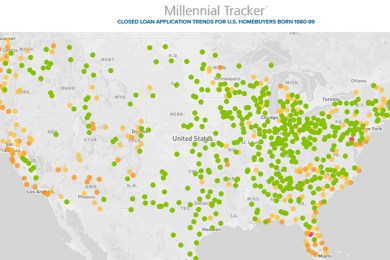

Millennials continue to take advantage of record-low interest rates, according to Ellie Mae, Pleasanton, Calif.

![]()

ATTOM Data Solutions, Irvine, Calif., said its third-quarter Special Report shows pockets of the Northeast and Mid-Atlantic regions most at risk, with clusters in the New York City, Baltimore, Philadelphia and Washington, D.C. areas - while the West and now Midwest are less vulnerable.

We apparently haven’t seen a bottom in mortgage interest rates—and it got a lot of borrowers off their couches, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending October 2.

With record-low interest rates and an ongoing rush of refinance demand, mortgage lenders are racing to process as much business as they can. How can their settlement service providers help?

The mPower event, Protocol: The Power of Diplomacy and How to Make it Work for You, takes place Tuesday, October 20 from 3:00-4:00 p.m. ET and features Capricia Marshall, who will share from her best-selling book of the same title and relate why protocol is important in everyone’s day to day lives.

When our entire workforce at Embrace Home Loans went remote in April, we faced the challenge of how to help make new employees feel welcome and part of the team. We’ve learned that managers are one of the most effective resources for building company culture. And this holds true not only for mortgage companies, but for most other industries as well.

MBA NewsLink interviewed Valerie Achtemeier, Executive Vice President at CBRE Capital Markets in the Debt & Structured Finance Group. Based in Los Angeles, Achtemeier leads a team in placing debt and equity on commercial real estate throughout the U.S.

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.

Temporary, alternative inspections methods help to demonstrate the reliability and benefits of bifurcation and may very well assist in the evolution of home appraisals.

Meridian Capital Group, New York, arranged $277.4 million to refinance three multifamily properties and a shopping center in New Jersey.