BREAKING NEWS

2Q Commercial/Multifamily Mortgage Debt Outstanding Increases; MISMO Approves Taxpayer Consent Language

The Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding report found commercial and multifamily mortgage debt outstanding rose by $43.6 billion (1.2 percent) in the second quarter.

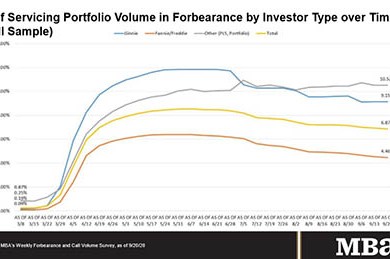

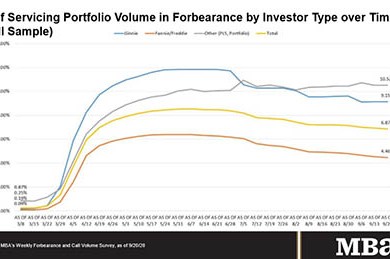

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

MISMO®, the mortgage industry standards organization, today announced that its successful Taxpayer Consent Language is approved as a new standard.

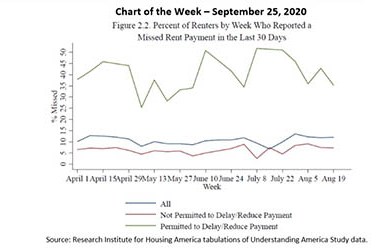

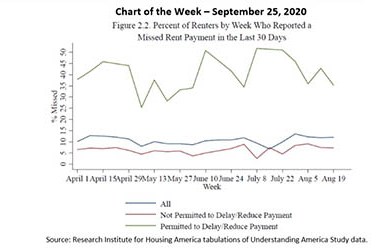

On September 17, the Research Institute for Housing America, MBA’s think tank, released a special report on housing-related financial distress during the second quarter – the first three months of the pandemic in the U.S.

Expert advice on maximizing current capacity, a winning market strategy, preparing your team for post-2020 success, and more.

Overlooking this factor when choosing an eClosing technology service provider could cost you.

JLL Capital Markets announced Rachael Lewis as a Director in its Los Angeles office, where she will be part of the debt and equity placement team led by Senior Managing Director Bill Fishel.

MBA is gearing up for its first-ever virtual Annual Convention & Expo. Taking place October 19-21 via MBA LIVE, attendees can connect whenever they want, from wherever they want.

Today’s financial services risk managers face two recurring issues. First, our work makes some people feel defensive; and second, we have to analyze complex business lines and correctly identify the right issues to focus upon.

The Mortgage Bankers Association is uniquely positioned to help our members and the commercial real estate finance industry address long-standing issues of social justice and inclusion as the premier trade association representing real estate finance.

Federal Reserve Chairman Jay Powell and Treasury Secretary Steven Mnuchin testified before House and Senate committees regarding the government’s response to the COVID-19 pandemic. On Tuesday, the Federal Housing Finance Agency published its strategic plan for the years 2021 through 2024, highlighting the agency’s ongoing efforts to reform the GSEs and improve its own internal operations.

Berkadia secured $66.2 million in financing for two Florida multifamily properties.