BREAKING NEWS

Applications Fall in MBA Weekly Survey

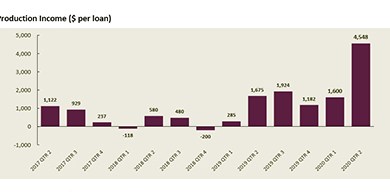

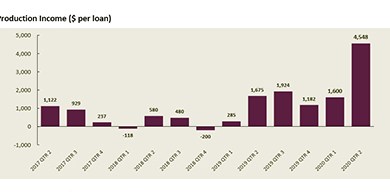

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $4,548 on each loan they originated in the second quarter, up from $1,600 per loan in the first quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

Mortgage applications fell for the third straight week even as interest rates dipped again, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 28.

Citing the need to “prevent the further spread of COVID-19,” the Trump Administration yesterday issued an order temporarily halting residential evictions through Dec. 31.

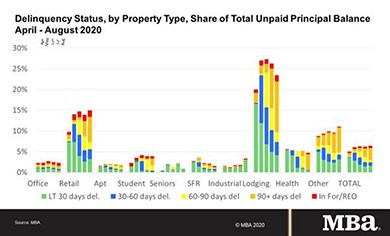

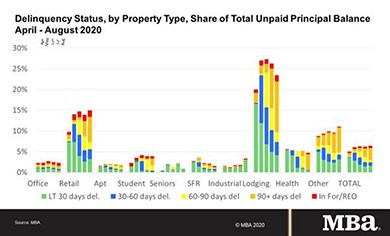

The coronavirus pandemic had a "dramatic and immediate impact" on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said in two reports.

Overlooking this factor when choosing an eClosing technology service provider could cost you.

Rental concessions are now nearly twice as common as in February as apartment owners strive to attract new tenants in a softened market, said Zillow, Seattle.

A new survey from CNBC, Englewood Cliffs, N.J., an Acorns, San Mateo, found Americans are saving more and spending less compared to before the pandemic with 60% of respondents call themselves “savers,” up from 54% a year ago.

The Mortgage Bankers Association asked the Federal Housing Finance Agency to restructure the capital framework for Fannie Mae and Freddie Mac, moving from past business models to a market utility approach that enables them to meet all of their obligations.

During COVID, you must ensure you are communicating clearly about your business and any changes that may be taking place in terms of how you are operating and the resulting impacts on applicants and borrowers.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Scott Gesell was recently appointed as CEO of Gateway First Bank, Tulsa, Okla. He has been an integral part of Gateway First Bank’s leadership since 2013. During his time at Gateway, he played a leading role in the merger of a 100-year-old community bank with a 20-year-old mortgage company to become Gateway First Bank.

Bellwether Enterprise, Cleveland, arranged $97.5 million to refinance seniors apartments in California and workforce housing in Fargo, N.D.